SMU Data and Models

SMU Survey Results: Fickle Steel Buyers Change Their Minds

Written by John Packard

March 19, 2017

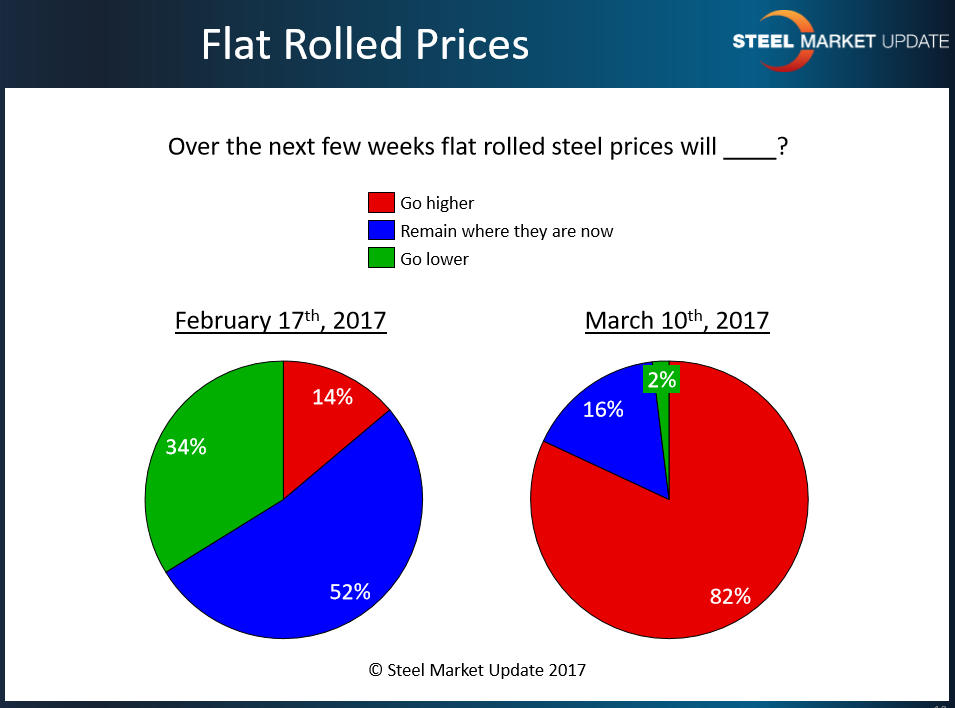

Over the course of a few weeks, buyers and sellers of flat rolled steels changed their view of the direction of flat rolled steel price direction. In the middle of February only 14 percent of those responding to our flat rolled steel market trends analysis survey reported prices would move higher with the majority (52 percent) believing steel prices would remain where they were and about one third (34 percent) believing prices would move lower. We got a strong push on scrap prices which prompted the domestic mills to push prices higher. The price announcements should not have come as a surprise as mills like Nucor were advising their customers of another round of increases should scrap move more than $30-$40 per gross ton. Prime grades ended up moving higher by about $65 per gross ton (+/- depending on regional market factors).

What Our Respondents Had to Say in Early March

“With the dramatic move in scrap prices I am anticipating we will see a $50 a ton price increase announcement sometime in the next 7 calendar days.” Manufacturing company

“Zinc extras alone pushing Galv prices higher.” Manufacturing company

“Scrap will be the cause… I don’t know how sustained it will be. Demand is not as robust as people think.” Service center

“I expect pricing will go higher with March scrap prices, but with the Nucor DRI facility coming back online and weaker export market, I believe there will be a ceiling to the increases. The key for me will be to watch China steel pricing as a leading indicator for global raw materials and steel pricing.” Manufacturing company

“Lead times are not moving out significantly.” Canadian Manufacturing company

The question now becomes what happens should we see a stable to slight reduction in scrap prices as we move into April negotiations?

Scrap guru Mike Marley of World Steel Dynamics, provided some color on the topic in an article published to his customers on March 15th:

“Busheling and bundles prices spanned a huge range this month, from a low of $340 per ton in the East to as high as $440 per ton for some remote deals. Also, the $60-per-ton increase made most dealers sellers this month. Some traders said that while it is still only mid-March, they nevertheless expect a sideways market in April, at least for industrial scrap prices, or at worst only a soft sideways market with industrial scrap prices off by only $5 or $10 per ton. Obsolete scrap prices could decline more, especially if the warmer spring weather brings out more obsolete scrap and export demand doesn’t rise.

“This industrial scrap demand boom could mean the mills are now carrying sufficient inventories to protect them from any further price increases over the next few months, said a veteran Chicago area trader. Next month, he said, the mills might choose to slash prices for all grades because they bought enough this month or are still owed some scrap at month’s end. However, dealers sold heavily in March and could pull back their offers in April and May. By June, he said, the mill inventories might be very low. Also, the mills will be aware of the upcoming summer vacation outages at auto stamping plants and the impact of those shutdowns on industrial scarp supplies. That could set off another buying binge in June.”

John Packard

Read more from John PackardLatest in SMU Data and Models

Steelmaking raw material prices mixed in April

Prices of steelmaking raw materials have moved in different directions over the last 30 days, according to Steel Market Update’s latest analysis.

March service center shipments and inventories report

Flat Rolled = 58.3 shipping days of supply Plate = 60.6 shipping days of supply Flat Rolled US service center flat-rolled steel inventories edged up in March as shipments remained low. At the end of March, service centers carried 58.3 shipping days of supply on an adjusted basis, up from 56.6 shipping days in February. […]

SMU survey: Buyers’ sentiment increases

SMU’s Steel Buyers’ Sentiment Indices both rose this week.

SMU market survey results now available

The latest SMU market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Historical survey results are also available under that selection. If you need help accessing the survey results, or if […]

SMU survey: Sheet lead times contract, plate pushes out

The market appears to be taking a pause after the heavy buying that occurred in March.