Plate

July 5, 2023

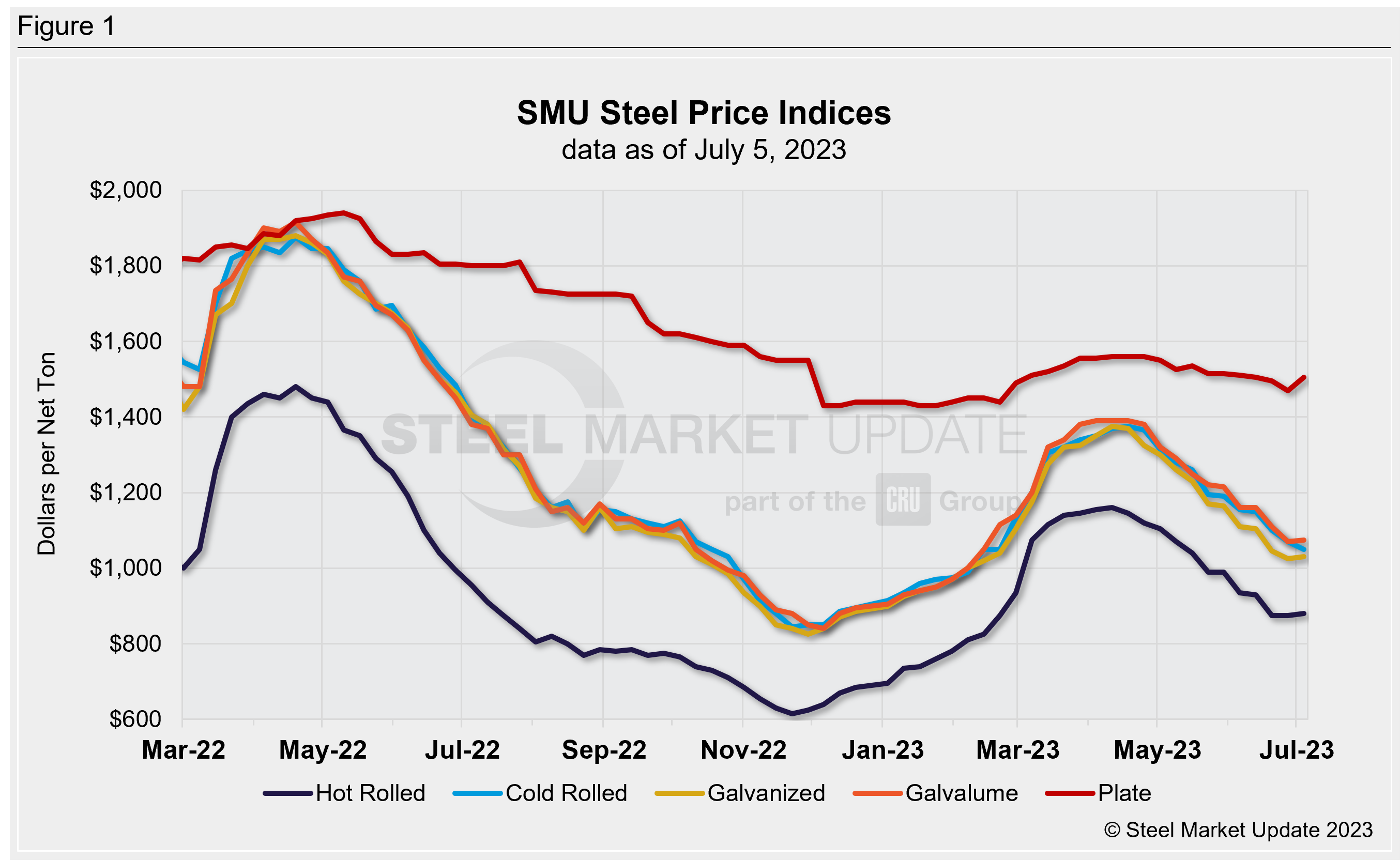

SMU Price Ranges: Sheet Holds Mostly Steady, Plate Inches Up

Written by Michael Cowden

Sheet prices were little changed this week amid typically slower activity around the Fourth of July.

Market participants said that another round of sheet price hikes might come later this week or early next to shore up an initial round of price increases announced in mid-June.

In the meantime, some of the heavy discounting that occurred last month – think HRC prices in the $700s per ton for large buyers – is now out of the market, sources said.

SMU’s hot-rolled coil price was little changed at $880 per ton, up $5 per ton from a week ago. Galvanized and Galvalume prices were also up $5 per ton. Cold roll, in contrast, was down $20 per ton – but that could reflect limited activity rather than a significant market move.

Plate prices bucked the trend. They were up $35 per ton because discounting that had been in that segment in recent weeks has dissipated following Nucor’s announcement of flat prices. Plate also has brighter long-term prospects than sheet markets, market sources noted.

All our sheet and plate pricing momentum indicators remain at neutral. We will keep them there until a clearer trend establishes itself after the shortened holiday week.

Hot-Rolled Coil: The SMU price range is $830–930 per net ton ($41.50–46.50 per cwt), with an average of $880 per ton ($44.00 per cwt) FOB mill, east of the Rockies. The bottom end of our range was unchanged vs. one week ago, while the top end was up $10 per ton week on week (WoW). Our overall average is up $5 per ton WoW. Our price momentum indicator for hot-rolled coil remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Hot-Rolled Lead Times: 3–7 weeks*

Cold-Rolled Coil: The SMU price range is $1,000–1,100 per net ton ($50.00–55.00 per cwt), with an average of $1,050 per ton ($52.50 per cwt) FOB mill, east of the Rockies. The lower end of our range moved lower by $40 per ton WoW, while the top end was unchanged compared to a week ago. Our overall average is down $30 per ton WoW. Our price momentum indicator on cold-rolled coil remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Cold-Rolled Lead Times: 5–9 weeks*

Galvanized Coil: The SMU price range is $960–1,100 per net ton ($48.00–55.00 per cwt), with an average of $1,030 per ton ($51.50 per cwt) FOB mill, east of the Rockies. The lower end of our range was down $10 per ton vs. last week, while the top end of our range edged up $20 per ton vs. one week ago. Our overall average is up $5 per ton vs. the prior week. Our price momentum indicator on galvanized steel remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Galvanized .060” G90 Benchmark: SMU price range is $1,057–1,197 per ton with an average of $1,127 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3–10 weeks*

Galvalume Coil: The SMU price range is $1,000–1,150 per net ton ($50.00–57.50 per cwt), with an average of $1,075 per ton ($53.75 per cwt) FOB mill, east of the Rockies. The lower end of the range was sideways vs. last week, while the top end was up just $10 per ton WoW. Our overall average increased $5 per ton when compared to one week ago. Our price momentum indicator on Galvalume steel remains at neutral, meaning direction is unclear over the next 30 days in light of the latest round of mill price hikes.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,294–1,444 per ton with an average of $1,369 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–8 weeks*

Plate: The SMU price range is $1,450–1,560 per net ton ($72.50–78.00 per cwt), with an average of $1,505 per ton ($75.25 per cwt) FOB mill. The lower end of our range was up $70 per ton compared to the prior week, while the top end of our range was unchanged WoW. Our overall average was up $35 per ton vs. the prior week. Our price momentum indicator on steel plate remains at neutral, meaning we are unsure of what direction prices will go over the next 30 days.

Plate Lead Times: 4–9 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By Michael Cowden, michael@steelmarketupdate.com