Product

January 30, 2013

Durable Goods Orders and Shipments Rise in December

Written by Sandy Williams

Written by: Sandy Williams

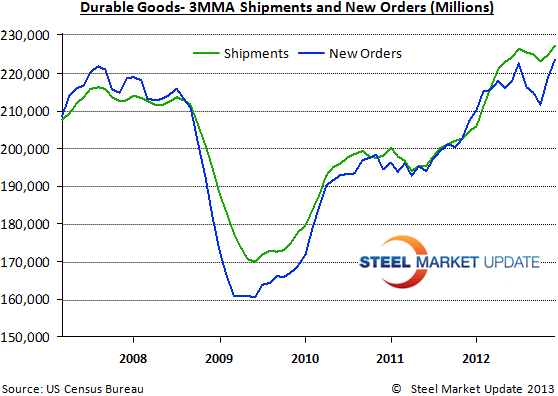

New orders and shipments for manufactured durable goods both rose in December. New orders increased $10 billion or 4.6 percent to $230.7 billion, rising for the fourth consecutive month according to figures released by the Department of Commerce. New orders have been up seven of the last eight months, with transportation equipment showing the largest increase, $8.1 billion or 11.9 percent to $75.9 billion.

New orders and shipments for manufactured durable goods both rose in December. New orders increased $10 billion or 4.6 percent to $230.7 billion, rising for the fourth consecutive month according to figures released by the Department of Commerce. New orders have been up seven of the last eight months, with transportation equipment showing the largest increase, $8.1 billion or 11.9 percent to $75.9 billion.

Shipments have been up five of the last six months and increased 1.3 percent to $230.6 billion. Primary metals had the largest increase, up 4.2 percent to $30.7 billion.

Unfilled orders for manufactured goods increased 0.8 percent in December to $992 billion. Transportation equipment drove the increase in unfulfilled orders, up 1.6 percent to 588.8 billion.

Inventories fell for the first time in 14 months by $0.1 billion to $374.5 billion. Machinery led the increase with a drop of $0.4 billion to $66.1 billion.

Capital Goods in December for nondefense goods rose by 3.8 percent to $73.8 billion. Shipments increased 0.7 percent to $71.9 billion. Unfilled orders rose 0.3 percent to $585.7 billion. Inventories for nondefense capital goods decreased 0.3 percent to $173 billion.

Defense new orders for capital goods surged in December by 110.4 percent to $16.5 billion. Shipments rose 6.1 percent to $9.1 billion. Unfilled orders rose 4.6 percent to $171.5 billion. Inventories of defense capital goods fell 1.4 percent to $21.2 billion.

DOC reported revised seasonally adjusted figures for November for all manufacturing industries: new orders, $477.4 billion (revised from $477.6 billion); shipments, $484.3 billion (revised from $483.7 billion); unfilled orders, $983.9