Product

January 30, 2013

SMU Price Ranges & Indices: Not Enough Movement to Make Changes

Written by John Packard

As we made our rounds over the past few days we found a number of the smaller mills who had not yet announced price increases and were continuing to collect orders at the previous prices. We also found a few instances of larger mills continuing to collect prices at the lower end of our scale either at pre-agreed to pricing prior to the increase announcements or for “other” reasons.

AK Steel, in their conference call with analysts would only say regarding current spot prices, “…prices are trending higher, but not moving as quickly as we’d like them to be going, we’re now certainly north of $600 a ton which is a better place than we’ve been recently.” Quite an interesting admission by AK Steel.

Most buyers with whom SMU has communicated have not purchased much steel on the spot market since the price increases were announced.

For 9 straight weeks our SMU Price Momentum Indicator has been stuck in Neutral and this week is no exception. The market struggles to find enough “push” or “pull” to move prices decisively in one direction or another.

Here is how we see prices this week:

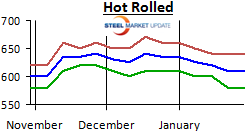

Hot Rolled Coil: SMU Range is $580-$640 per ton ($29.00/cwt-$32.00/cwt) with an average of $610 per ton ($30.50/cwt) fob mill, east of the Rockies. Our hot rolled prices have not changed over those from last week. The trend for HR continues to be “Neutral” as we wait to see if buyers will get off their hands and begin buying before mills begin making special offers in order to move steel. We did not a decline in HR lead times this week.

Hot Rolled Coil: SMU Range is $580-$640 per ton ($29.00/cwt-$32.00/cwt) with an average of $610 per ton ($30.50/cwt) fob mill, east of the Rockies. Our hot rolled prices have not changed over those from last week. The trend for HR continues to be “Neutral” as we wait to see if buyers will get off their hands and begin buying before mills begin making special offers in order to move steel. We did not a decline in HR lead times this week.

Hot Rolled Lead Times: 2-5 weeks

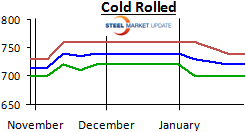

Cold Rolled Coil: SMU Range is $700-$740 per ton ($35.00/cwt-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) fob mill, east of the Rockies. Our cold rolled prices have not changed over those from last week. The trend for CR is Neutral as the market waits to see if buyers will now begin buying and move lead times out or if the domestic mills will need to offer discounts in order to entice buyers in order to fill their order books.

Cold Rolled Coil: SMU Range is $700-$740 per ton ($35.00/cwt-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) fob mill, east of the Rockies. Our cold rolled prices have not changed over those from last week. The trend for CR is Neutral as the market waits to see if buyers will now begin buying and move lead times out or if the domestic mills will need to offer discounts in order to entice buyers in order to fill their order books.

Cold Rolled Lead Times: 4-7 weeks

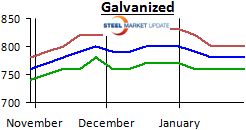

Galvanized Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. Our galvanized prices have not changed over those from last week. The trend is Neutral for galvanized which, like hot rolled and cold rolled wait for the buyers and sellers to sort out who is going to lead whom.

Galvanized Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. Our galvanized prices have not changed over those from last week. The trend is Neutral for galvanized which, like hot rolled and cold rolled wait for the buyers and sellers to sort out who is going to lead whom.

Galvanized .060” G90 Benchmark: SMU Range is $760-$800 with an average of $780 per ton.

Galvanized Lead Times: 4-7 weeks

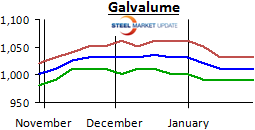

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. Our Galvalume prices have not changed over those from last week. The trend is Neutral for Galvalume as we wait for the buyers and sellers to sort out who needs the order more and when – do the buyers need to buy first or the mills need to sell and in the process offer a discount.

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. Our Galvalume prices have not changed over those from last week. The trend is Neutral for Galvalume as we wait for the buyers and sellers to sort out who needs the order more and when – do the buyers need to buy first or the mills need to sell and in the process offer a discount.

Galvalume .0142” AZ50 Grade 80 Benchmark: SMU Range is $991-$1031 per ton with an average of $1011 per ton.

Galvalume Lead Times: 4-7 weeks.