Product

February 1, 2013

HRC Futures Move Sideways Amidst a Skeptical Market

Written by Bradley Clark

Written by: Brad Clark, Director of Steel Trading, Kataman Metals

Settlement prices have barely moved this week as the recent price hikes have done little to inspire the futures market.

After a couple of month of sideways movements in the physical market the last couple of weeks have seen the market take a steep turn to the south. Last week’s mill price increase announcements have caused the market to pause and reevaluate pricing ideas. With very little change in underlying market fundamentals, including scrap costs, many feel this week’s current respite in price declines will be short lived. In order for a sustained uptrend in prices the market will need to see demand come on stronger, particularly in the construction and energy sectors to complement the unbounded strength of the auto industry.

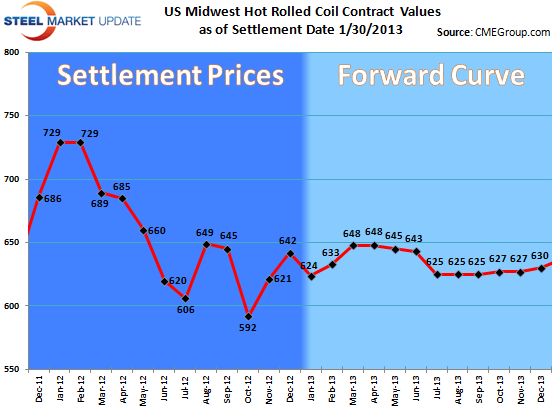

Despite moderate volume in the futures market this week, price action leaves little to inspire. The steep slope of the forward curve that we have seen in the futures market over the past month continues to get tamped down as spot prices continued to weaken, which in turn pulled down the prices of the nearby futures months. We see this with a spot price falling to around $600 after January settled at $621.80 while the February futures contract is trading at $635 and March-April is around $645

There seems to be a sentiment bubbling under the surface that futures prices may be set to pull back despite a steady to strengthening physical market. It feels that the recent belief in futures prices moving above $650 has dissipated and a realization that spot pricing is likely stuck in a range between $590-$640 for the first half of this year is beginning to take hold.

Volumes have been decent this week with over 8,500 tons trading focused primarily on the nearby q1 periods.

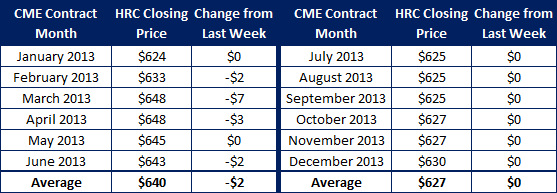

Below is a table with yesterday’s HRC futures settlement prices on the CME contract for each individual month through Q2 2013 as of 1/30/2013 close

OPEN INTEREST: 10,213 lots (1 lot = 20 short tons)