Product

February 20, 2013

SMU Price Ranges & Indices: Flat

Written by John Packard

Flat rolled steel prices remained – well, flat – this week compared to one week ago. Steel Market Update (SMU) Price Momentum Indicator is now in its 12th week at Neutral as we watch flat rolled steel prices drift without any real pressure to move prices higher, or lower at this time.

Here is how we see spot prices this week:

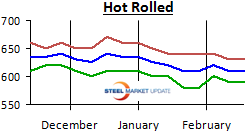

Hot Rolled Coil: SMU Range is $590-$630 per ton ($29.50/cwt-$31.50/cwt) with an average of $610 per ton ($30.50/cwt), fob mill, east of the Rockies. Both the lower and upper end of our range remained the same as one week ago. Our average also remained the same as it was one week earlier. The trend for hot rolled remains stuck in a “weak” neutral as prices drift based on the weekly needs of the domestic steel mills. At the moment, we do not see anything which will “push” prices firmly in one direction or another and we anticipate this drift to continue into early March.

Hot Rolled Coil: SMU Range is $590-$630 per ton ($29.50/cwt-$31.50/cwt) with an average of $610 per ton ($30.50/cwt), fob mill, east of the Rockies. Both the lower and upper end of our range remained the same as one week ago. Our average also remained the same as it was one week earlier. The trend for hot rolled remains stuck in a “weak” neutral as prices drift based on the weekly needs of the domestic steel mills. At the moment, we do not see anything which will “push” prices firmly in one direction or another and we anticipate this drift to continue into early March.

Hot Rolled Lead Times: 2-5 weeks.

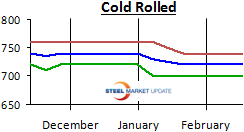

Cold Rolled Coil: SMU Price Range is $700-$740 per ton ($35.00/cwt-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) fob mill, east of the Rockies. Both the lower and upper end of our range remained the same as one week ago. Our average also remained the same as it was one week earlier. The trend for cold rolled remains stuck in a “weak” neutral as prices drift based on the weekly needs of the domestic steel mills. At the moment, we do not see anything which will “push” prices firmly in one direction or another and we anticipate this drift to continue into early March.

Cold Rolled Coil: SMU Price Range is $700-$740 per ton ($35.00/cwt-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) fob mill, east of the Rockies. Both the lower and upper end of our range remained the same as one week ago. Our average also remained the same as it was one week earlier. The trend for cold rolled remains stuck in a “weak” neutral as prices drift based on the weekly needs of the domestic steel mills. At the moment, we do not see anything which will “push” prices firmly in one direction or another and we anticipate this drift to continue into early March.

Cold Rolled Lead Times: 4-7 weeks.

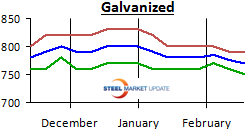

Galvanized Coil: SMU Base Price Range is $34.50/cwt-$36.50/cwt with an average of $35.50/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range dropped by $10 per ton while the upper end of our range remained intact when compared to one week ago. Our average is now $5 per ton less than one week ago. The trend for galvanized remains stuck in a “weak” neutral as prices drift based on the weekly needs of the domestic steel mills. At the moment, we do not see anything which will “push” prices firmly in one direction or another and we anticipate this drift to continue into early March.

Galvanized Coil: SMU Base Price Range is $34.50/cwt-$36.50/cwt with an average of $35.50/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range dropped by $10 per ton while the upper end of our range remained intact when compared to one week ago. Our average is now $5 per ton less than one week ago. The trend for galvanized remains stuck in a “weak” neutral as prices drift based on the weekly needs of the domestic steel mills. At the moment, we do not see anything which will “push” prices firmly in one direction or another and we anticipate this drift to continue into early March.

Galvanized .060” G90 Benchmark: SMU Range is $750-$790 per ton with an average of $770 per ton.

Galvanized Lead Times: 3-6 weeks.

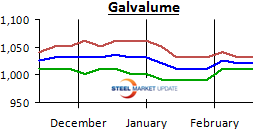

Galvalume Coil: SMU Base Price Range is $36.00/cwt-$37.00/cwt with an average of $36.50/cwt plus applicable extras, fob mill, east of the Rockies. Both the lower and upper end of our range remained the same as one week ago. Our average also remained the same as it was one week earlier. The trend for Galvalume remains stuck in a “weak” neutral as prices drift based on the weekly needs of the domestic steel mills. At the moment, we do not see anything which will “push” prices firmly in one direction or another and we anticipate this drift to continue into early March.

Galvalume Coil: SMU Base Price Range is $36.00/cwt-$37.00/cwt with an average of $36.50/cwt plus applicable extras, fob mill, east of the Rockies. Both the lower and upper end of our range remained the same as one week ago. Our average also remained the same as it was one week earlier. The trend for Galvalume remains stuck in a “weak” neutral as prices drift based on the weekly needs of the domestic steel mills. At the moment, we do not see anything which will “push” prices firmly in one direction or another and we anticipate this drift to continue into early March.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1011-$1031 per ton with an average of $1021 per ton.

Galvalume Lead Times: 5-8 weeks.