Product

March 13, 2013

SMU Price Ranges & Indices: Price Moving Up

Written by John Packard

The domestic mills are trying to collect increases – some are a little more adamant than others – but there does appear to be an effort. Lead times continue to be relatively short for this time of year. Demand levels are inconsistent with a number of service centers reporting slower shipments than anticipated for the month of March.

One service center put it to SMU this way earlier today, “No end user fears prices will be going up, nor do they believe prices will fall much from here either. So, there is no sense of urgency out there.”

Steel Market Update is finding flat rolled steel prices as beginning to increase albeit slowly. Here is how we see market prices this week:

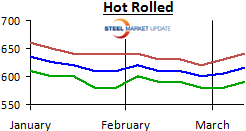

Hot Rolled Coil: SMU range is $590-$640 per ton ($29.50/cwt-$32.00/cwt) with an average of $615 per ton ($30.75/cwt) fob mill, east of the Rockies. The lower end of our range increased by $10 per ton as did the upper end of our range. Our average is also up by $10 per ton compared to one week ago. The trend for HR continues to be Neutral as we wait to see if the mills can build some momentum from here or if prices will continue to drift within a tight range as they have been over the past couple of months.

Hot Rolled Coil: SMU range is $590-$640 per ton ($29.50/cwt-$32.00/cwt) with an average of $615 per ton ($30.75/cwt) fob mill, east of the Rockies. The lower end of our range increased by $10 per ton as did the upper end of our range. Our average is also up by $10 per ton compared to one week ago. The trend for HR continues to be Neutral as we wait to see if the mills can build some momentum from here or if prices will continue to drift within a tight range as they have been over the past couple of months.

Hot Rolled Lead Times: 2-5 weeks.

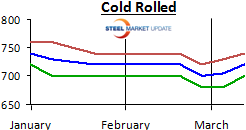

Cold Rolled Coil: SMU range is $700-$740 per ton ($35.00/cwt-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) fob mill, east of the Rockies. The lower end of our range increased by $20 per ton while the upper end of our range improved by $10 per ton compared to one week ago. Our average is $15 per ton higher than this time last week. The trend for CR is Neutral as we wait to see if the domestic mills can build some momentum from here.

Cold Rolled Coil: SMU range is $700-$740 per ton ($35.00/cwt-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) fob mill, east of the Rockies. The lower end of our range increased by $20 per ton while the upper end of our range improved by $10 per ton compared to one week ago. Our average is $15 per ton higher than this time last week. The trend for CR is Neutral as we wait to see if the domestic mills can build some momentum from here.

Cold Rolled Lead Times: 4-7 weeks.

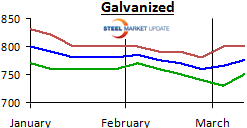

Galvanized Coil: SMU Base Price range is $34.50/cwt-$37.00/cwt with an average of $35.75/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range is up by $20 per ton while the upper end of the range remained intact compared to last week. Our average adjusted higher by $10 per ton. The trend for galvanized is Neutral as we wait to see if the domestic mills can build some momentum from here.

Galvanized Coil: SMU Base Price range is $34.50/cwt-$37.00/cwt with an average of $35.75/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range is up by $20 per ton while the upper end of the range remained intact compared to last week. Our average adjusted higher by $10 per ton. The trend for galvanized is Neutral as we wait to see if the domestic mills can build some momentum from here.

Galvanized .060” G90 Benchmark: SMU range is $750-$800 per ton with an average of $775 per ton.

Galvanized Lead Times: 4-8 weeks.

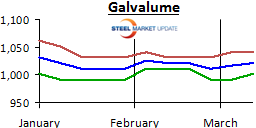

Galvalume Coil: SMU Base Price range is $35.50/cwt-$37.50/cwt with an average of $36.50/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range increased by $10 per ton while the upper end of the range remained the same as one week ago. The trend for Galvalume is Neutral as we wait to see if the domestic mills can build any momentum from here.

Galvalume Coil: SMU Base Price range is $35.50/cwt-$37.50/cwt with an average of $36.50/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range increased by $10 per ton while the upper end of the range remained the same as one week ago. The trend for Galvalume is Neutral as we wait to see if the domestic mills can build any momentum from here.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU range is $1001-$1041 per ton with an average of $1021 per ton.

Galvalume Lead Times: 4-8 weeks.