Product

March 18, 2013

Steady Business Conditions Ahead Says PMA Report

Written by Sandy Williams

Written by: Sandy Williams

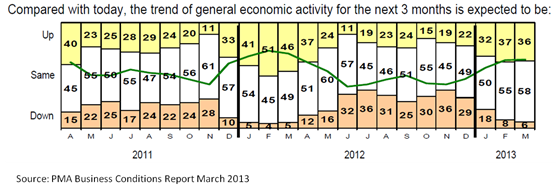

Metalforming companies are expecting business to be steady for the next three months according to the March 2013 Precision Metalforming Association Business Conditions Report. Optimism has been rising since November and has flattened out in February and March.

Incoming orders are not expected to change much in the next three months. Average daily shipping levels have increased slightly in March compared to three months ago and are not expected to change much in the next three. Lead times are similar to those of three months ago.

Metalforming companies reporting layoffs or short time dropped to 11 percent in March down from 19 percent in February making it the lowest level since March 2012 when 10 percent of workers were on short time or layoff.

“PMA’s manufacturing member companies reported fairly strong orders and shipments in the first quarter of 2013 vs. the last quarter of 2012,” said William E. Gaskin, PMA president. “However, compared to the first quarter of 2012, they are operating at similar levels. In calendar year 2012, orders and shipments started strong, then fell off substantially in early summer, recovered somewhat in early fall and then fell sharply again at year-end. In 2013, the trend line looks pretty similar so far. The real question will come as summer approaches, as to whether there will be a pull-back in consumer spending that impacts the rest of the year.”

The PMA Business Conditions Report, an economic indicator for manufacturing, is a monthly survey based on a sampling of metalforming companies in the United States and Canada. This month 114 metalforming companies participated in the survey.