Prices

September 4, 2013

HRC Futures Market: August Contract Volume Down

Written by John Packard

The number of open contracts (open interest) traded through the CME Group (NYMEX) during the month of August 2013 was 2,572 contracts (51,440 tons). This is lower than the 2,874 contracts (57,480 tons) traded in July and is 15.8 percent lower than the 3,055 contracts traded one year ago (61,100 tons).

The news looks a little brighter when comparing year-to-date (YTD) numbers. Through the end of August the volume totaled 37,533 contracts (750,660 tons) up from the 29,483 contracts traded during the same time period in 2012 (589,660 tons).

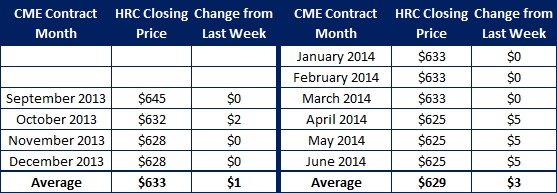

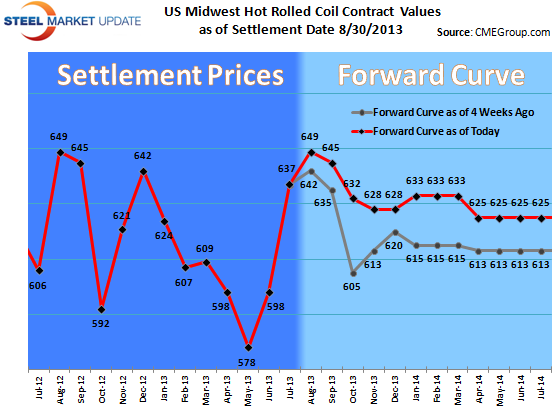

Below is the forward curve for hot rolled coil (HRC) futures as of the end of August. We have provided the information in both a table and graph format. Our graph also shows where the forward curve was four weeks earlier.