Market Data

September 8, 2013

Industry to Soon be Over-Supplied and Prices Forecast to Drop

Written by John Packard

This past week, Steel Market Update (SMU) conducted our beginning of September steel market survey. Of those responding to last week’s survey 52 percent were manufacturing companies, 35 percent steel service centers and the balance were composed of steel mills (4 percent), trading companies (4 percent), toll processors (3 percent) and suppliers to the industry (2 percent).

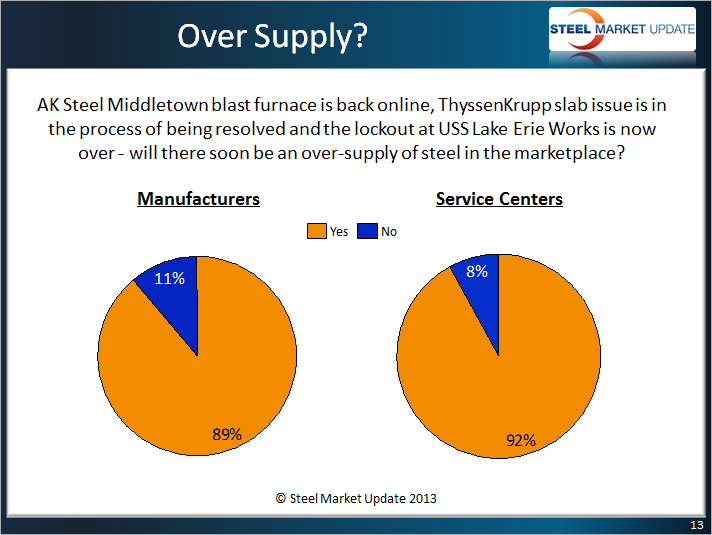

By wide margins, our respondents believe that the flat rolled steel market will be in over-supply due to the return of the Middletown blast furnace, the resolution of the ThyssenKrupp slab issues and the union returning to work at Lake Erie Works. When our question was put to manufacturing companies and services centers independently the results were the same. Close to 90 percent of service centers and over 90 percent of manufacturing companies believe there will soon be an over-supply of steel.

By wide margins, our respondents believe that the flat rolled steel market will be in over-supply due to the return of the Middletown blast furnace, the resolution of the ThyssenKrupp slab issues and the union returning to work at Lake Erie Works. When our question was put to manufacturing companies and services centers independently the results were the same. Close to 90 percent of service centers and over 90 percent of manufacturing companies believe there will soon be an over-supply of steel.

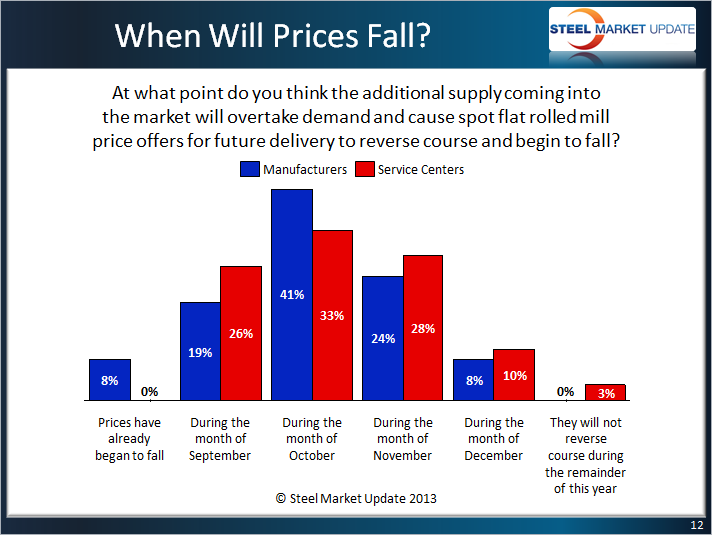

So the question becomes at what point will spot prices begin to be impacted by the return of supply to the marketplace? Twenty seven percent of the manufacturing companies believe prices have either already begun to decline (8 percent) or will during the month of September (19 percent). Service centers did not pick up on declining prices prior to September as their first response was 26 percent during the current month.

By the time we reach October the majority believes prices will have begun to fall by the end of that month. Sixty eight percent of manufacturing companies couple with fifty nine percent of service centers reported prices will drop by the end of October. As you can see by the graphic provided the next most popular month was November.

By the time we reach October the majority believes prices will have begun to fall by the end of that month. Sixty eight percent of manufacturing companies couple with fifty nine percent of service centers reported prices will drop by the end of October. As you can see by the graphic provided the next most popular month was November.

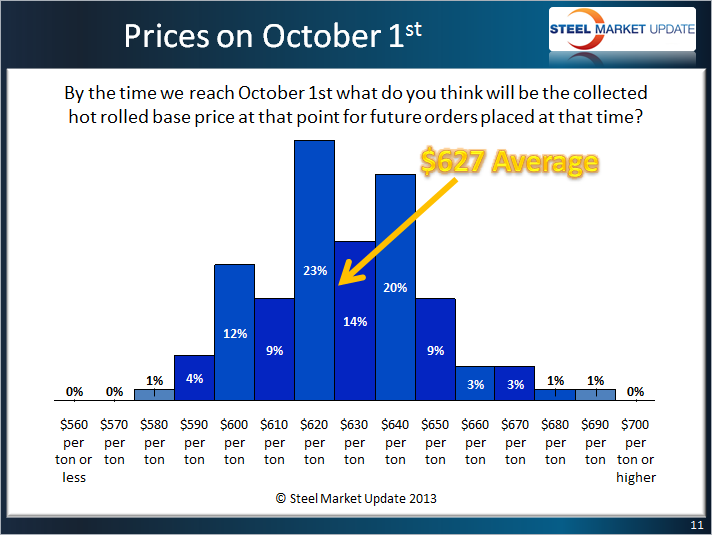

According to our survey respondents, by October 1st benchmark hot rolled prices are forecast to be much lower than the $645 average reported by Steel Market Update last Tuesday. In fact only 17 percent of the respondents believe prices will be above our current average. The average of the respondents was $627 per ton which would be $18 per ton below existing levels.