Distributors/Service Centers

September 8, 2013

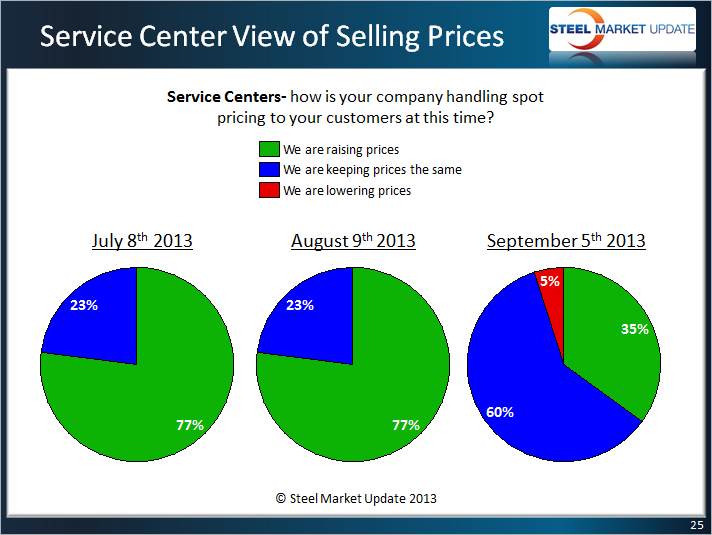

Service Centers Reporting Fewer Raising Spot Prices

Written by John Packard

Flat rolled steel service centers have moved away from pushing spot flat rolled price increases as they were at the beginning of July and then again at the beginning of August. Those reporting that their company was keeping steel prices the same grew from 23 percent at the beginning of August to 60 percent this past week. Those raising prices shrunk to 35 percent from 77 percent and for the first time in awhile we had a small percentage (5 percent) reporting that their company was lowering spot pricing to their customers.

The introduction of lower spot prices out of the service centers is normally a harbinger toward a push to reduce prices at the domestic mill suppliers.

Manufacturers confirmed the move toward balanced pricing in the spot service center markets. This past week 68 percent of the OEM’s reported stable spot prices and the balance (32 percent) reported prices as being higher.

SMU Price Momentum Indicator at an Uneasy Neutral

Steel Market Update has heard of early leaks in the dam as a couple of conversion mills have been reported to be taking spot galvanized numbers down to the $36.00/cwt-$36.50/cwt base levels. SMU galvanized base price average this past week was $37.35/cwt.

Steel Market Update Price Momentum Indicator continues to reference “Neutral” as the direction for steel prices over the next few weeks. We will be watching mill lead times, negotiations (which are indicating a stronger willingness on behalf of the domestic mills to entertain negotiations), scrap prices (which are down this month by approximately $10 per gross ton) and competition between service centers in the spot market. Our indicator is still at Neutral but we are seeing early signs of erosion in negotiations, scrap and service center spot pricing.