Prices

November 24, 2013

Service Centers Continue to Push Flat Rolled Spot Prices Higher

Written by John Packard

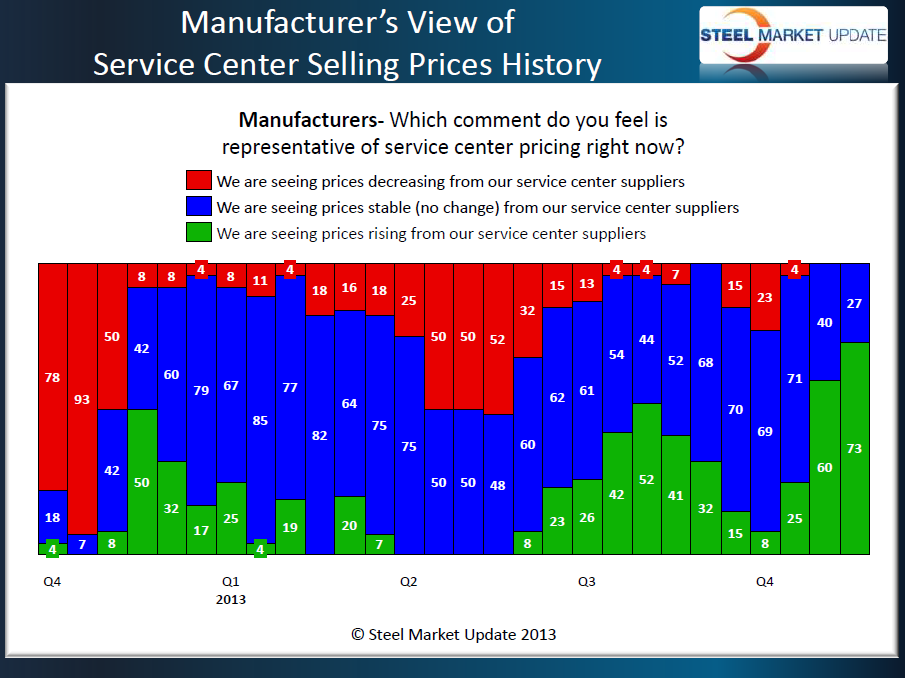

Manufacturing companies are reporting the prices being offered by service centers are essentially only moving in one direction – higher. End users, responding to the most recent flat rolled steel market analysis conducted by Steel Market Update this past week, reported prices as rising as compared to remaining the same by a 73 percent to 27 percent margin. This is an increase from the 60 percent reported at the beginning of the month. The trend to higher spot prices out of the distributors has become well established after a weak start at the beginning of October.

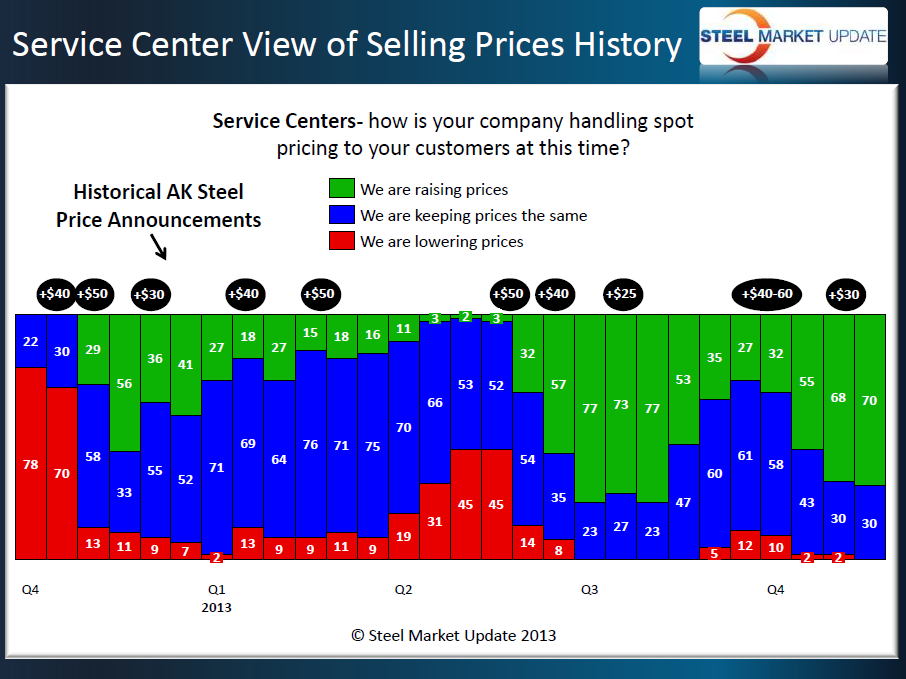

Flat rolled steel distributors concurred with their customers as 70 percent of the service centers reported their spot prices as rising with the balance reporting prices as being stable.

Neither the manufacturing companies nor the distributors reported any offers to discount spot pricing at this time.

Based on our analysis of the service center spot pricing data over the past few years, it is SMU’s opinion that when service centers are acting to move spot prices higher – especially in the percentages seen since the beginning of November – the greater the ability of the domestic steel mills to keep prices firm or moving higher. This can be seen in the graphic shared below. The black numbers shown above the bar represent the AK Steel publically announced price increases.