Market Data

December 29, 2013

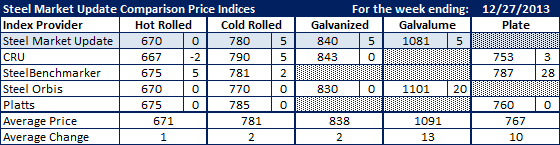

SMU Comparison Price Indices: Sideways to Small Ticks Higher

Written by John Packard

This past week we saw little movement in pricing on most flat rolled steel products due to the Holidays and a general lack of new orders flowing through the system. Benchmark hot rolled is in a fairly tight range at $667 on the low side (CRU) to $675 on the high side (Platts/Steelbenchmarker). The hot rolled average of the indices we follow on a regular basis was $671 per ton.

Cold rolled had a wider range from a low of $770 (Steel Orbis) to a high of $790 (CRU) the average was $781 per ton.

The galvanized range was $830 (Steel Orbis) to $843 (CRU) with an average of $838 per ton. This is based on .060” G90.

Galvalume ranged from $1081 to $1101 per ton for .0142” AZ50, Grade 80 with an average of $1091 per ton.

Plate, our newest addition, ranged from $753 (CRU) to $787 (Steelbenchmarker) with an average of $767 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Within 200-300 mile radius of Northern Indiana Domestic Mill.