Market Data

February 23, 2014

Hot Rolled Lead Times Slip – Others Rally

Written by John Packard

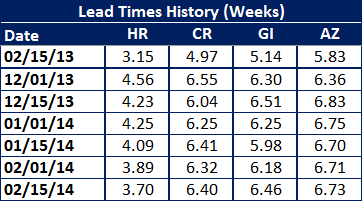

Domestic mill lead times hardly budged according to our most recent SMU steel market survey of the flat rolled steel market. Those participating in our survey put the average hot rolled lead time at 3.70 weeks. This is down slightly from the 3.89 weeks measured at the beginning of the month. The three month moving average for HR lead times is 4.12 weeks.

All of the other products – cold rolled, galvanized and Galvalume actually saw increases in their lead times compared to the beginning of February.

The 3 month moving average for cold rolled is 6.33 weeks so our current reading of 6.40 is slightly above the 3MMA. The galvanized 3MMA is 6.28 weeks and like cold rolled the current reading of 6.46 is above the moving average. Lastly, the Galvalume 3MMA is 6.68 weeks and the current 6.73 weeks is above the 3 month moving average.

When looking back to where lead times were measured one year ago, we find in each and every case the market is stronger this year than last. This may be why steel prices are $35 per ton higher than this same time last year.

If you would like to see more detail and history we have an interactive graph and table of all of the data collected based on our surveys on our website. This data is available for Premium, Executive and free trial members. You will need to log into the site and the data can be found under the Analysis tab (Survey Results – Lead Times).