Market Data

May 1, 2014

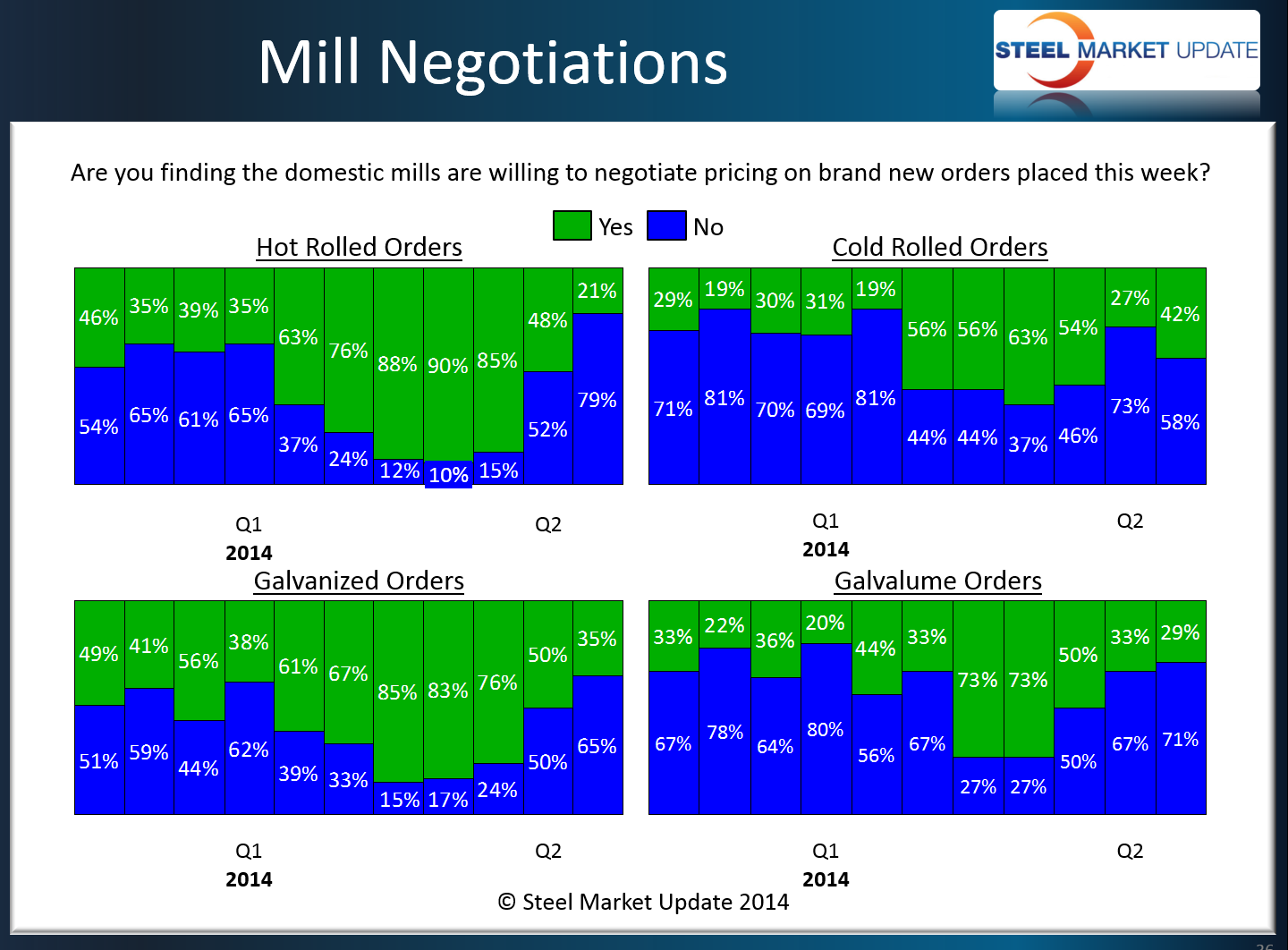

Steel Mills Less Willing to Negotiate Flat Rolled Steel Prices

Written by John Packard

Flat rolled steel mills have become less willing to negotiate flat rolled steel spot prices with their customers. During the analysis of the flat rolled steel market conducted by Steel Market Update earlier this week, we found large adjustments in negotiations on hot rolled pricing as well as spot galvanized steel pricing. Cold rolled actually saw a moderation in negotiations while Galvalume remained essentially the same as what we captured at the beginning of the month.

Hot rolled has seen the greatest movement, according to those responding to our twice monthly surveys. The percentage of our respondents, which were reporting the mills as willing to negotiate just over a month ago (85 percent), has dropped to 21 percent. This latest reading is one of the lowest levels seen during the history of our survey and speaks to the strength or resolve of the steel mills as they move to collect all of the increases announced.

In each case, the percentages are telling us that the vast majority of buyers are finding flexibility in negotiations as hard to come by. Our gut feel (although not asked in the survey) is those buyers located in the northern sections of the U.S. and into Canada are finding negotiations more difficult than those in the southern and southeastern section of the country where mill production issues are not weighing on the producing mills in this area of the country.