Prices

June 8, 2014

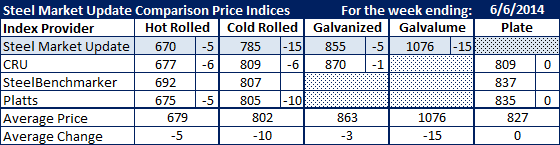

SMU Comparison Price Indices: Price Slide Continues

Written by John Packard

Prices dropped on all flat rolled items with the exception of plate which remained the same as one week ago. Hot rolled prices dropped by an average of $5 per ton, cold rolled by an average of $10 per ton, galvanized by $3 per ton and Galvalume by $15 per ton.

With the latest drop in each of the indexes (with the exception of SteelBenchmarker which did not report new pricing this past week), Steel Market Update has adjusted our SMU Price Momentum Indicator from Neutral to Lower. We believe prices will continue to inch lower in the coming weeks.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.