Prices

June 15, 2014

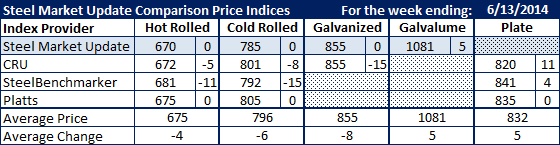

SMU Comparison Price Indices: Catch Up

Written by John Packard

Two flat rolled steel price indexes, Steel Market Update and Platts, saw little movement in flat rolled steel prices this past week. The two indexes are probably the closest they have been in some time with SMU showing hot rolled pricing averaging $670 per ton ($33.50/cwt) while Platts has their benchmark HRC price at $675 per ton ($33.75/cwt). CRU was down $5 per ton to $672 and SteelBenchmarker, which only reports prices twice per month, was down $11 per ton to $681 per ton.

The SMU Comparison Price Indices average for hot rolled coil pricing is $675 per ton, down $5 per ton over the past week.

As with hot rolled, cold rolled pricing was flat when looking at Steel Market Update and Platts price indices. SMU is showing our cold rolled pricing average as $785 per ton ($39.25/cwt) while Platts reported CRC pricing at $805 per ton. Both CRU and SteelBenchmarker took their cold rolled price indices down by $8 and $15 per ton, respectively.

The SMU Comparison Price Indices average for cold rolled pricing was $796 per ton, down $8 per ton over the past week.

Galvanized prices remained the same at $855 per ton on .060” G90 galvanized product, which is the benchmark used by ourselves and the CRU index which dropped their number by $15 per ton and matched our $855 per ton number.

The SMU Comparison Price Indices average for galvanized pricing is $855 per ton, down $8 per ton over the past week.

SMU reported Galvalume pricing at $1081 per ton, up $5 per ton compared to the previous week.

Plate prices rose $11 according to the CRU index and are now referenced as $820 per ton. SteelBenchmarker also reported a price increase on the plate pricing with their $841 per ton up $4 compared to the prior week. Platts plate price index remained the same at $835 per ton.

The SMU Comparison Price Indices average for plate pricing is $832 per ton, up $8 per ton over the past week.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.