Market Data

June 22, 2014

Demand Starting to Retreat?

Written by John Packard

Last week Steel Market Update conducted our mid-June flat rolled steel market analysis. We sent invitations to slightly more than 600 companies which are involved in the flat rolled steel industries as buyers, sellers or toll processors of the steel. The participants in last week’s analysis came from the manufacturing industry (45 percent), service center/wholesalers (42 percent), trading company (6 percent), steel mill (4 percent), toll processor (2 percent) and suppliers to the steel industry (1 percent).

SMU announced the results of our Steel Buyers Sentiment Index on Thursday of last week (+57).

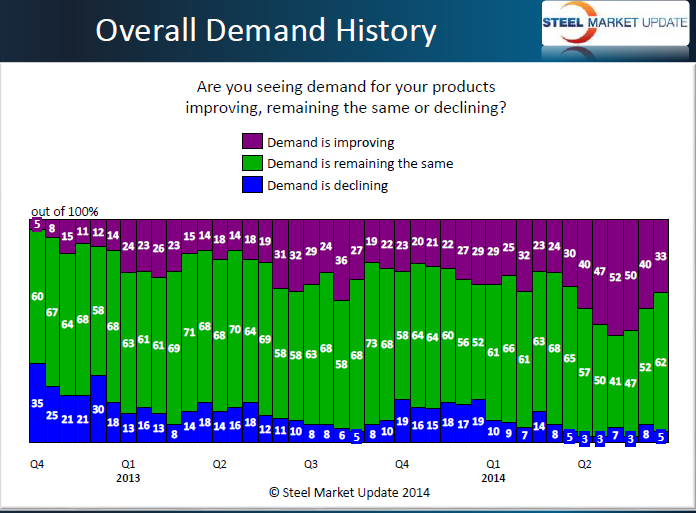

During the survey process SMU is looking for changes in market trends such as demand where we are beginning to see an waning of the good news as our respondents are reporting in greater numbers that demand remains the same (62 percent up from 52 percent at the beginning of June) versus improving (33 percent vs. 40 percent). Those who are reporting demand as in decline was down slightly from 8 percent at the beginning of June to 5 percent last week.

Demand, and changes in demand, is something we will need to watch very closely in the coming weeks. If there is indeed a pullback in demand, when combined with more supply both foreign and domestic we could see a build in inventories thus impacting lead times and pricing.

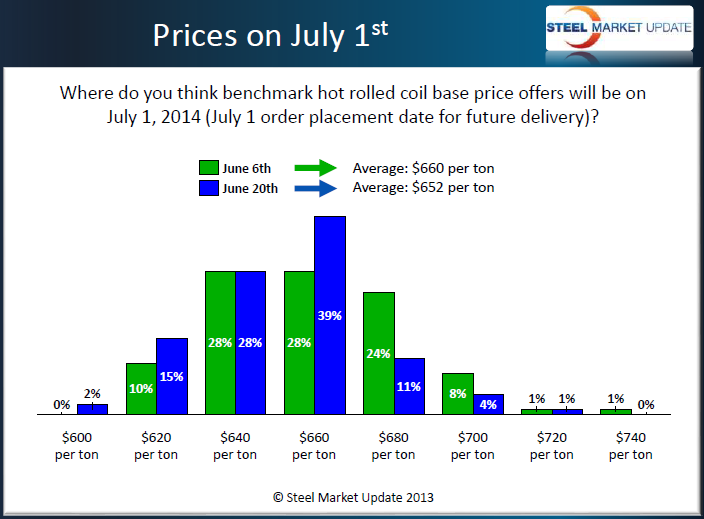

We reported our flat rolled steel price ranges and averages last Tuesday with benchmark hot rolled averaging $665 per ton down $5 from the week prior. The trend we are watching is the direction our respondents believe pricing is headed by the end of the month. There has been little change since our early June analysis when 51 percent reported that they believe prices will be moving lower by the end of the month. That number dropped slightly this past week and now only 58 percent are of the same opinion.

The average of all of the responses regarding where HRC spot pricing will be come July 1 rose over the past couple of weeks. At the beginning of June the consensus (average) was $652 per ton. Now the consensus is $660 per ton which would mean prices would need to drop another $5 per ton from our assessment from last Tuesday.