Market Data

August 21, 2014

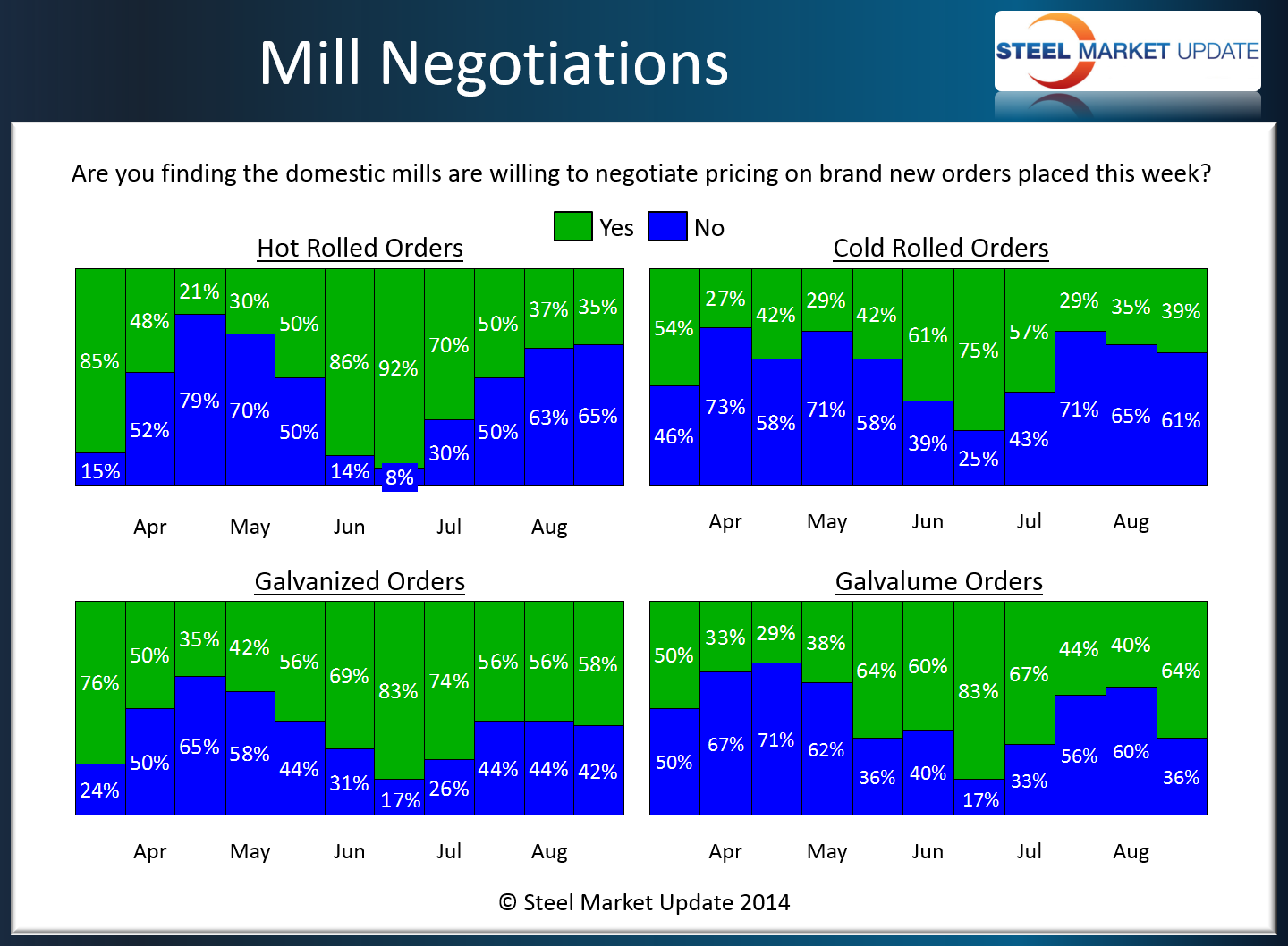

SMU Steel Survey: Steel Mill Negotiations

Written by John Packard

Based on our latest Steel Market Update analysis of the flat rolled steel markets, we are learning that the domestic steel mills were more willing to negotiate galvanized and Galvalume pricing than hot rolled and cold rolled steel pricing.

The largest movement we saw was on Galvalume where 64 percent of our respondents reported the mills as being willing to negotiate pricing this week. This is up from the 40 percent reported at the beginning of August.

The galvanized response rate remained about the same as 58 percent of our respondents reported the domestic mills as willing to negotiate galvanized transaction prices.

Cold rolled saw a very small uptick in the percentage of respondents reporting the domestic mills as willing to negotiate steel prices. The latest survey reported 39 percent vs. 35 percent of our respondents as reporting the mills as willing to negotiate pricing.

Thirty-five percent of our respondents reported the domestic mills as willing to negotiate hot rolled prices which is essentially the same as the 37 percent measured at the beginning of August.

SMU Note: You can view the interactive graphic on our steel mill negotiations data below when you are logged into the website and reading the newsletter online. If you have not logged into the website in the past and need your username and password, contact us at: info@SteelMarketUpdate.com or by calling 800-432-3475. If you need help navigating the website we would also be very happy to assist you.

{amchart id=”113″ SMU Negotiations by Product- Survey}