Market Data

September 21, 2014

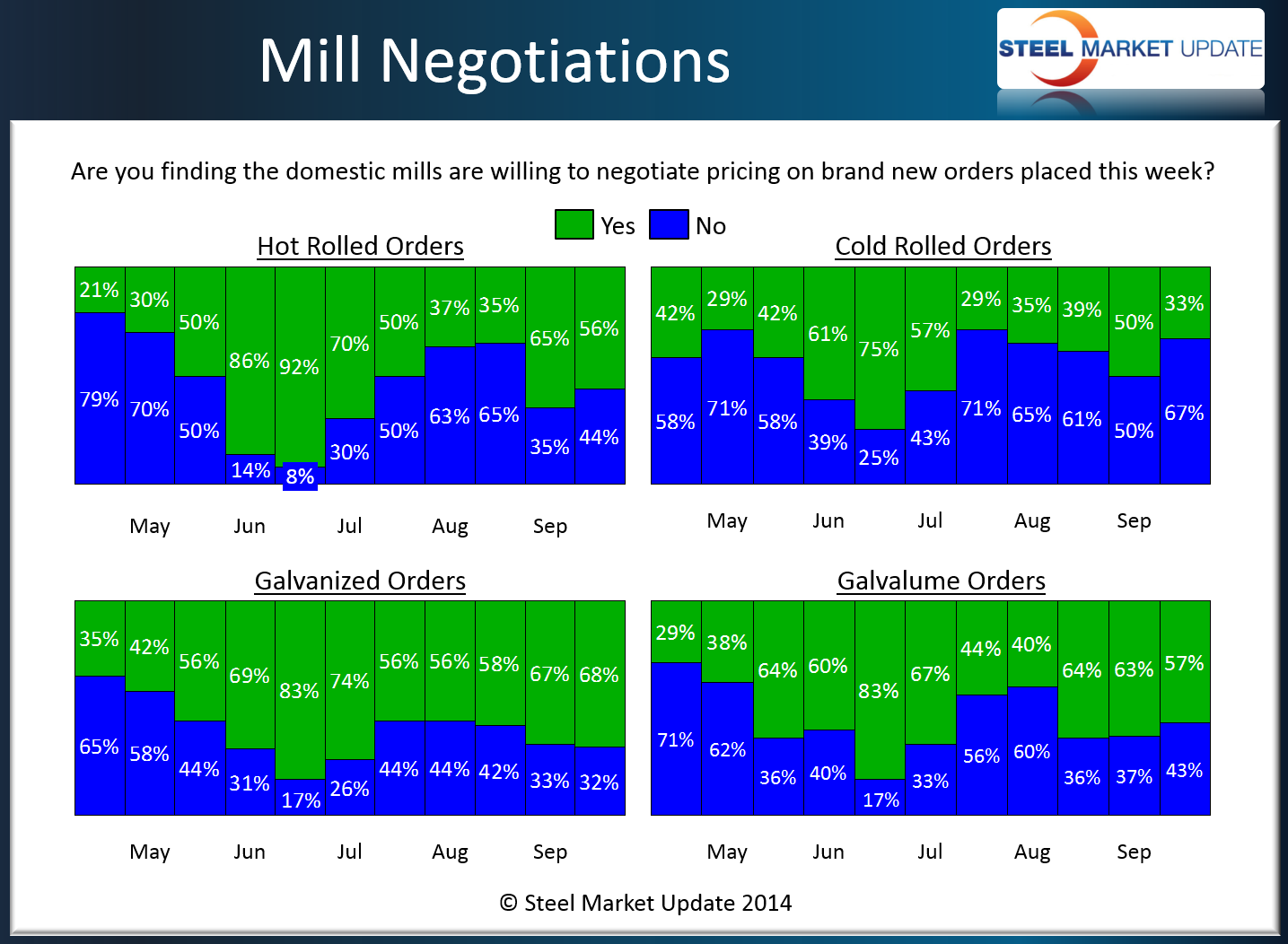

SMU Steel Survey Results: Steel Mill Price Negotiations

Written by John Packard

Flat rolled steel mills continue to negotiate pricing on hot rolled, galvanized and Galvalume products and less enthusiastically on cold rolled, according to our latest flat rolled steel market analysis conducted this past week.

Galvanized continued as the product manufacturing companies and service centers were reporting where prices were negotiable gathering 68 percent of the respondents from last week’s flat rolled steel survey. Galvalume was a little less flexible this past week at 57 percent versus the 63 percent reported at the beginning of the month. Hot rolled also dropped slightly from 65 percent at the beginning of September to 56 percent this past week. Cold rolled was the one product which appears to be holding it’s own as only one-third of the respondents indicated that the domestic mills were willing to negotiate CRC pricing. This is down from 50 percent at the beginning of the month and the lowest level reported since mid-July when we recorded a 29 percent response rate.

The more willing the domestic steel industry is to negotiate pricing the more volatility we are apt to see in flat rolled pricing. Prices have been slowly drifting lower over the past couple of months and our graphic below provides a point of reference as to how the manufacturing and distribution segments of the industry were viewing the negotiation process.

An interactive graphic can be seen below when you are reading the newsletter online. If you have not logged into the website in the past and need your username and password, contact us at: info@SteelMarketUpdate.com or by calling 800-432-3475. If you need help navigating the website we would also be very happy to assist you.

{amchart id=”113″ SMU Negotiations by Product- Survey}