Market Data

November 9, 2014

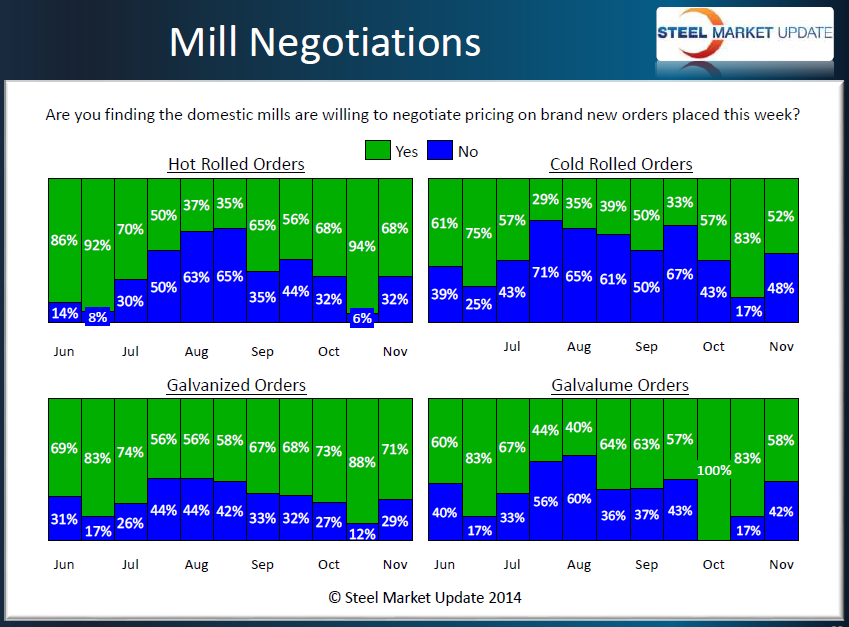

SMU Survey Results: Steel Mill Negotiations

Written by John Packard

Based on the responses from last week’s Steel Market Update survey of the flat rolled steel market, buyers and sellers of steel reported the domestic steel mills as less willing to negotiate steel prices than what we saw during the middle of October. However, even though the percentages were smaller, the majority of buyers and sellers of steel still were reporting the mills as willing to discuss prices on hot rolled, cold rolled, galvanized and Galvalume steels.

Hot rolled went from 94 percent of our respondents reporting the mills as willing to negotiate down to 68 percent.

Cold rolled dropped from 83 percent down to 52 percent. A 31 percent change since our last survey.

Galvanized appears to be the weakest product with 71 percent of those responding to last week’s survey reporting the mills as willing to negotiate versus the 88 percent reported during the middle of October.

Galvalume dropped from 83 percent down to 58 percent.

SMU attributes most of the change to a combination of domestic mill price increase announcements which were made after our last survey and some of the mills having sold out their order book through the end of the year.

Below is an interactive graphic of our Steel Mill Price Negotiations History, but it can only be seen when you are logged into the website and reading the newsletter online. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”113″ SMU Negotiations by Product- Survey}