Market Data

December 4, 2014

Flat Rolled Steel Mill Lead Times Slipping

Written by John Packard

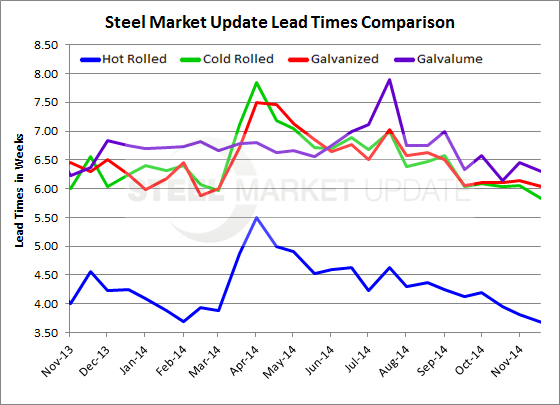

Steel Market Update (SMU) conducted our early December flat rolled steel market analysis this week. As part of the survey process, SMU asks those responding questions about flat rolled steel mill lead times. From their responses we create our average lead time for the industry by product. This allows us the ability to evaluate whether lead times are expanding or contracting which gives us an indication of the strength of the industry.

Lead times have been contracting over the past couple of months on hot rolled coil. Based on our survey results only, HRC appears to be the weakest of the four flat rolled products we analyze. Hot rolled lead times have gone from 4.2 weeks back in October to 3.59 weeks now (average). During the first week of December 2013 HR lead times were reported to be 4.56 weeks, one week longer than our current measurement.

Cold rolled lead times were at 6.58 weeks (average) during our mid-September market analysis. For the next four surveys CR lead times stabilized at 6.05 weeks before taking a dip this week and landing at 5.68 weeks. Last December CR lead times averaged 6.55 weeks or, almost one week longer than this week’s measurement.

We saw galvanized lead times at 6.50 weeks in mid-September and, like cold rolled, over the next couple of months (4 surveys) GI lead times stabilized at approximately 6.11 months. This week GI lead times fell to 5.97 weeks and are approximately half a week shorter than the 6.30 weeks measured the first week of December 2013.

Galvalume has been the product with the longest lead times. AZ lead times averaged 7.00 weeks in mid-September before declining by approximately half a week during the next 4 reporting periods (2 months). This week AZ lead times averaged 6.20 weeks which is relatively close to the 6.36 weeks measured at the beginning of December 2013.

Below is an interactive graphic of our Lead Times History, but it can only be seen when you are logged into the website and reading the newsletter online. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”112″ SMU Lead Times by Product- Survey}