Prices

December 7, 2014

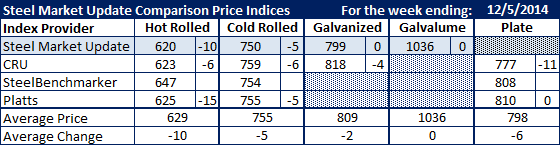

Comparison Price Indices: Another Step Down

Written by John Packard

Hot rolled prices dropped on all the indexes which reported new pricing this past week. Steel Market Update was down $10 per ton to $620 per ton with CRU ($623) and Platts ($625) coming very close to the SMU number. SteelBenchmarker did not report new pricing this past week as they only report HRC prices twice per month. The average of the three indexes reporting HRC prices is essentially $623 per ton, which has to be the closest the three of us have been in many months.

The key point is that HR pricing is adjusting at a faster pace than we have seen in quite some time.

Cold rolled prices also dropped and, like hot rolled, the spread between the three indexes reporting this week shrank. Steel Market Update is now $750 (down $5 from the prior week), Platts is $755 (down $5) and CRU is $759 (down $6).

Galvanized pricing for .060” G90 was $4 lower according to CRU while SMU keep our average the same at $799 per ton which is $19 per ton lower than CRU at this moment.

Galvalume remained unchanged for the week with plate prices dropping by $11 per ton (CRU) widening the spread between CRU and Platts ($810) to $33 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.