Overseas

December 14, 2014

Chinese Steel Export Tax Rebate Rumors Re-Surface

Written by John Packard

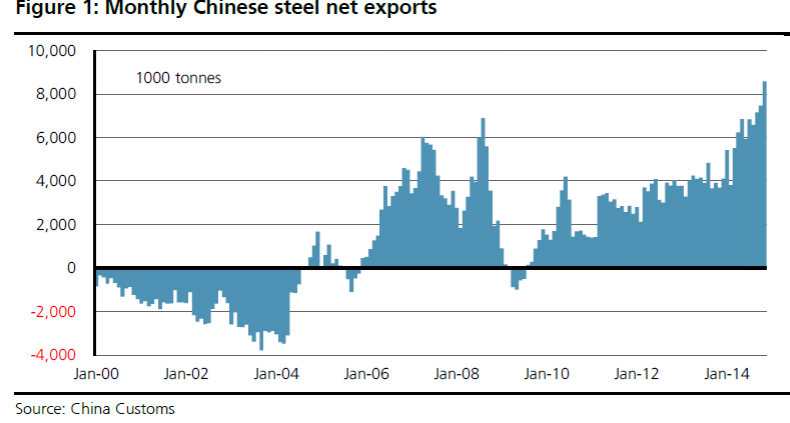

The subject of how China is going to deal with their surging steel exports continues in earnest after the release of the most recent Chinese export data. As the graphic shows below, the Chinese steel mills have spent this calendar year flooding the world markets with their steel excesses. In November the Chinese steel mills exported 9,720,000 metric tons (10,714,000 net tons) of steel products around the world. This is an increase of 12.1 percent over October’s 8,550,000 metric tons of steel exports.

Steel Market Update has been communicating with one of our trading sources in Asia who sells iron ore to the Chinese mills and trades steel out of the Chinese mills that is then shipped to locations around the world. We have been discussing the issue of VAT (Value Added Tax) which is placed on steel products and the rebates which are available on steels containing boron. The rumor has been that the Chinese government would remove the boron-added rebate.

For awhile the boron-added discussion dissipated and many thought the issue dead. Now, new rumors are coming out of China and the possible announcement date is this coming week (December 15-20, 2014). Here is what our trading source had to say earlier this month on the subject:

“There are unofficial rumors from reliable sources, but the announcement is not official as of yet. It is that ALL Export Tax Rebates are to be AXED. If this is true, Iron Ore will plummet, Domestic China market will plummet etc. as the export market will disappear unless there are some loopholes or Iron Ore drops the equivalent of the Tax Rebates being axed. Again, this is only rumors and it will be 15th-20th before any Official announcement comes. I will keep you updated.

“Ore will steady at USD68-70/mt before the announcement.

“Export Offers are idle waiting for this announcement.”

Iron ore spot pricing has indeed been holding steady at the $68-$70 per dry metric ton level over the past two weeks. We will see if the Chinese government makes a move this week or turns a blind eye to the massive exports of steel products which are creating political and ultimately economic turmoil for China.