Analysis

December 21, 2014

US Vehicle Sales & NAFTA Vehicle Production

Written by Peter Wright

November was a strong month for light vehicle sales rising to 17.2 million units, (annualized) from 16.5 million in October. This was the best result since August. So far in 2014 sales are averaging 16.45 million units, the best rate since 2006. Light trucks increased faster than automobiles in November presumably boosted by low gas prices. Trucks increased from 8.5 million to 9.0 million, cars from 8.0 million units to 8.2 million. Light trucks accounted for 52.5 percent of total sales, compared with 52.1 percent year to date. Chrysler is doing particularly well being up by 21 percent over the past 12 months. Its market share, at 13 percent, is the highest since 2007. Ford, which is starting up its aluminum intensive F150 line in Dearborn was down 1.7 percent over the year through November. The market share of imported vehicles was only 20.5 percent in November and has been falling steadily since early 2009.

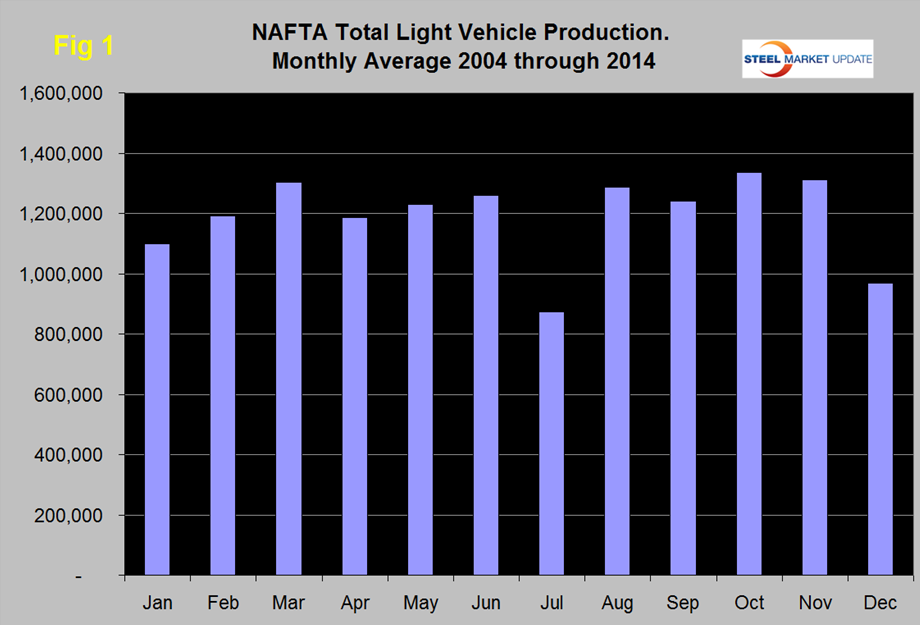

Total light vehicle production in NAFTA in November was at an annual rate of 16,226,040 units, down by 15.5 percent from October which was the highest production volume month since June 2000. On average since 2004, November production has declined 1.8 percent from October, (Figure 1).

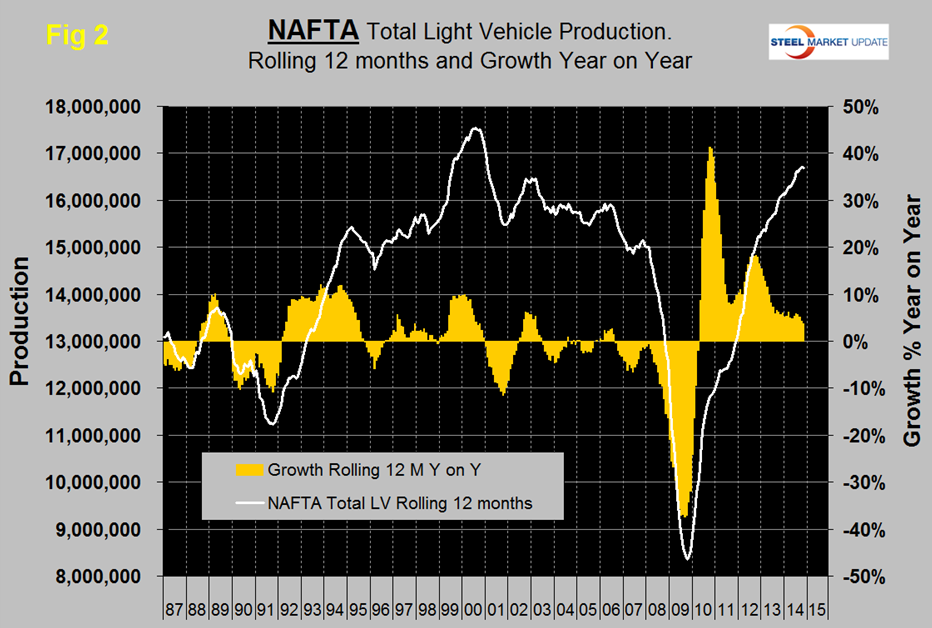

Note: these production numbers are not seasonally adjusted, the sales data reported above are seasonally adjusted. On a rolling 12 months basis y / y light vehicle production in NAFTA increased by 3.7 percent through November and is now well above the pre-recession peak, (Figure 2).

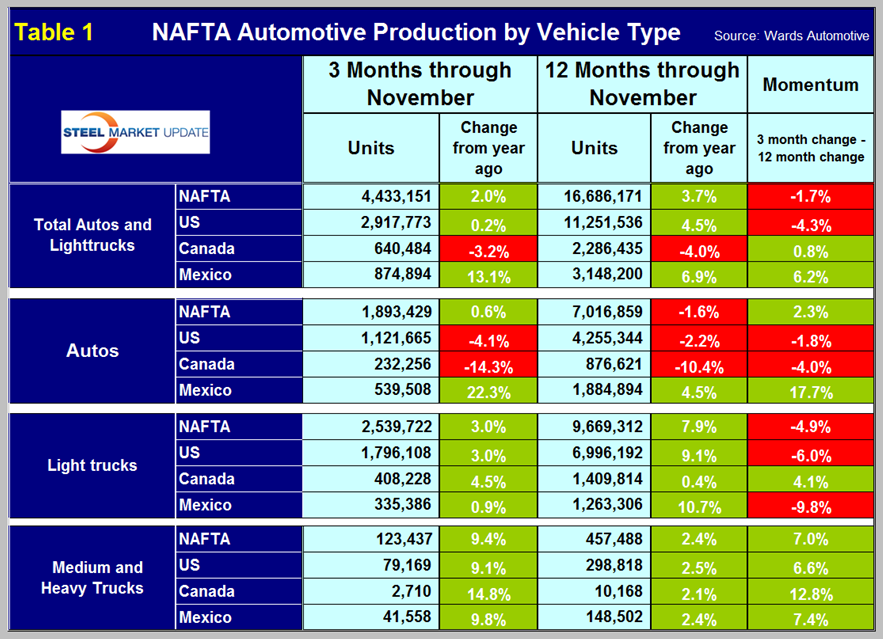

Growth has slowed for four straight months through November on a rolling 12 months basis. On this basis the US is up by 4.5 percent, Canada is down by 4.0 percent and Mexico is up by 6.9 percent, (Table 1). For NAFTA as a whole on a rolling 12 month basis year over year, light truck production is up by 7.9 percent and autos are down by 1.6 percent. Ford began the initial phase of deliveries of the aluminum intensive F150 this month. The plan to be at full production in Dearborn by the end of December. The company spent an estimated $350 million to re-tool including four press lines to stamp four grades of high strength aluminum sheet and installing new lines to hydroform support rails.

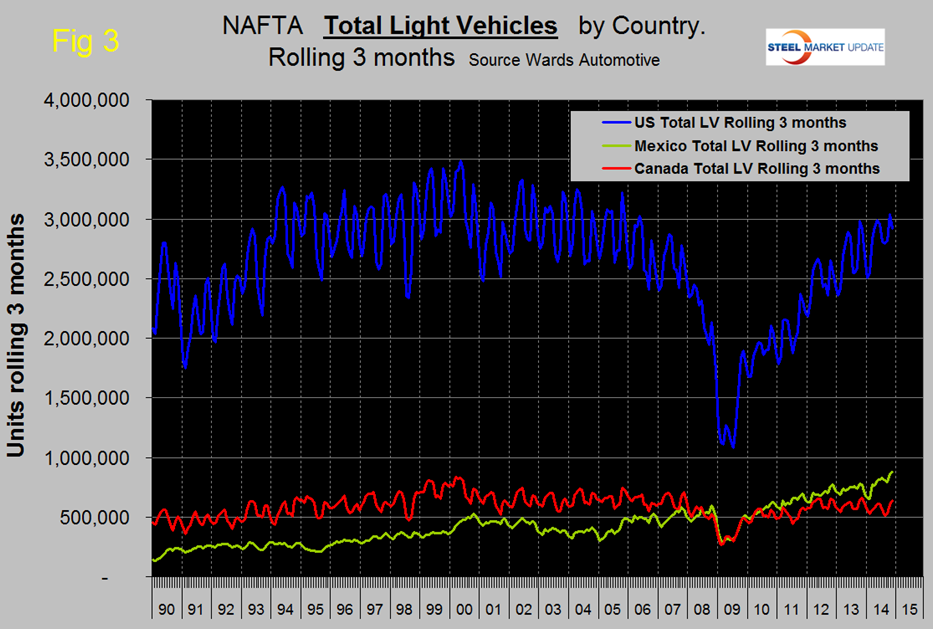

To put the production of the three NAFTA countries into perspective, US output of total light vehicles in Q3 was 5.3 times that of Canada and 3.6 times that of Mexico, (Figure 3).

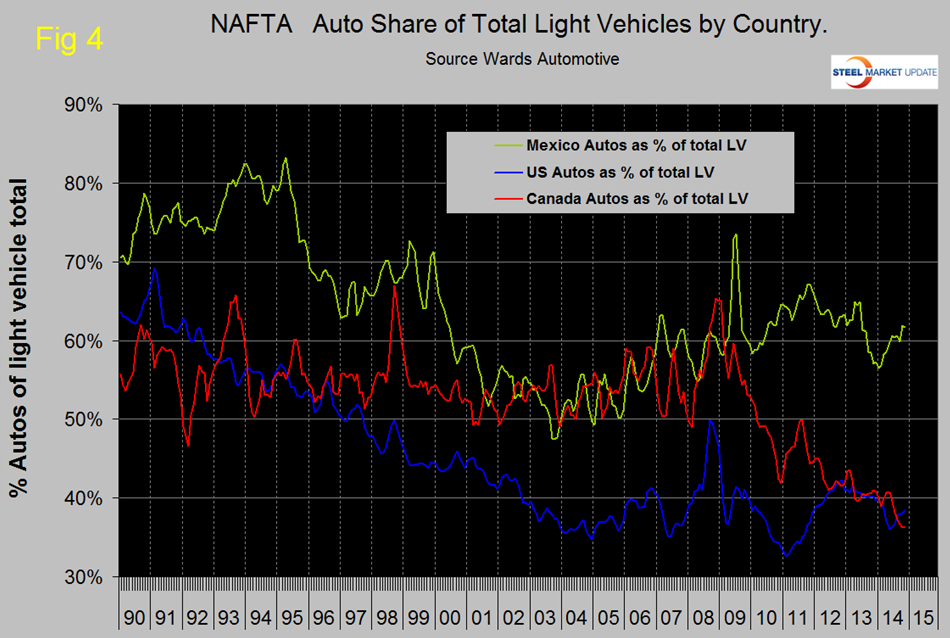

The mix of light vehicles is very different by country, (Figure 4). The percentage of autos in the Mexican mix is over 60 percent but only 38.4 in the US and 36.3 percent in Canada.

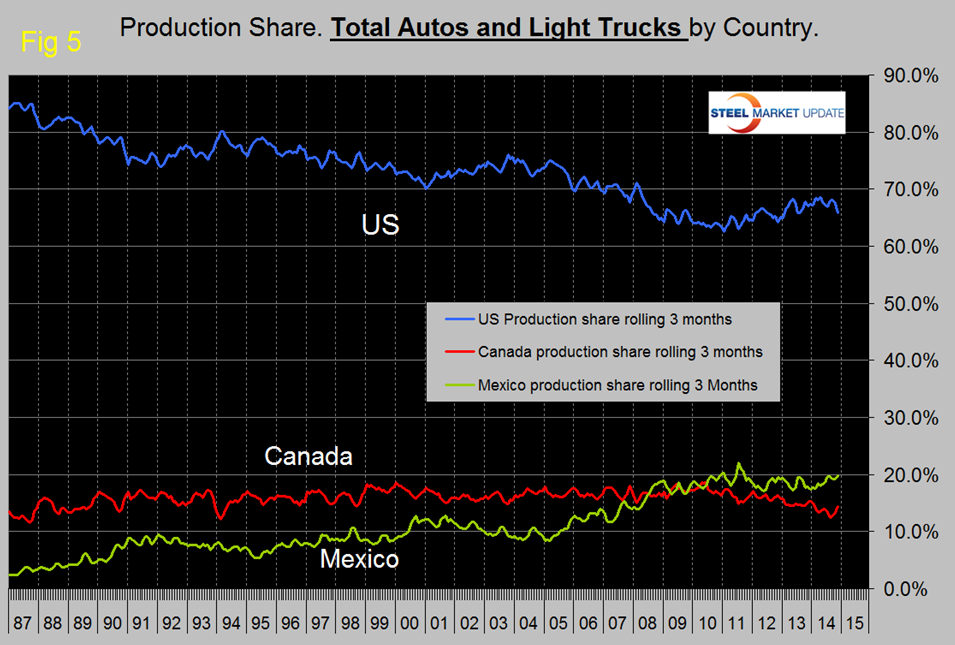

In the last four years the US production share has been increasing at the expense of Canada, Mexico’s share has been virtually unchanged in that time period, (Figure 5). However over the shorter time period of 2014 Mexico has taken some share from the US.

Ward’s Automotive reported last week that total light vehicle inventories in the US declined by five days of sales in November to seventy days. This is six days lower than in November last year. Inventories of the Detroit three declined in November by five to eighty four, the Asian manufacturers declined by five days to sixty one, and the Europeans declined by six to fifty.

The SMU data file contains more detail than be shown here in this condensed report. Readers can obtain copies of additional time based performance results on request if they wish to dig deeper. Available are graphs of auto, light truck and medium and heavy truck production, growth rate and production share by country.