Prices

February 8, 2015

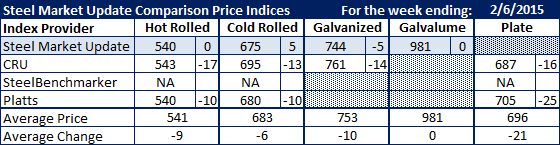

Comparison Price Indices: Catch Up as Spread Between Indexes Shrinks

Written by John Packard

The range between indexes shrank this past week as benchmark hot rolled coil price averages dropped to $541 per ton, with SMU and Platts now even at $540 per ton and CRU slightly higher at $543 per ton. We did not include SteelBenchmarker pricing as they only produce pricing twice per month and we have decided to only use numbers from those who actually index the items in the week being analyzed.

Cold rolled continues to buck historical norms as our average is $142 per ton which is higher than the normal $100-$120 per ton premium for the product. Coated products are similarly out of whack with historical norms. We would expect CR and coated to revert back to more normal spreads over benchmark hot rolled in the coming weeks.

Plate prices dropped the most during the past week with CRU taking their number down $16 per ton and Platts by $25 per ton. Note that there is a difference in the FOB points between the two indexes. Platts is Southeast mill while CRU is Midwest.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.