Market Data

March 22, 2015

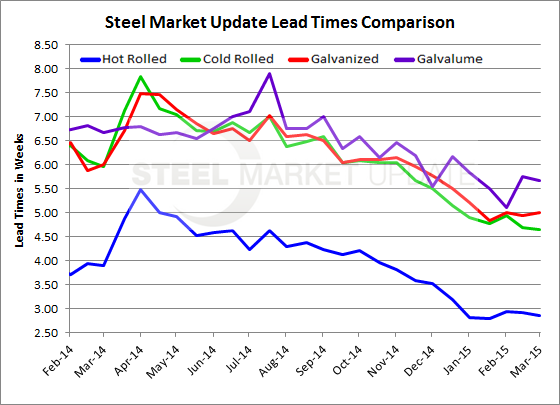

Steel Mill Lead Times Remain Short

Written by John Packard

One of the most import keys being watched by buyers and sellers of flat rolled steel are the steel mill lead times on hot rolled, cold rolled, galvanized and Galvalume products. Lead times, which are the amount of time it takes to get material produced once a purchase order is placed, have been running “short” which means the mills are able to produce the coils quicker than normal.

Based on the results of our most recent flat rolled steel market analysis (survey) which was conducted this past week, lead times essentially remained the same as what we have been reporting since the beginning of the year.

The following lead times are based on the average of the responses that we received from those responding to our questionnaire. Individual steel mills may have lead times which are longer (more extended) or shorter than our average based on their product mix and order flows.

Hot rolled lead times remained at just under 3 weeks. The 2.86 week average is one week shorter than what was measured one year ago when lead times averaged 3.89 weeks on HRC.

Cold rolled lead times remained under 5 weeks as they have all the way back to the middle of January. One year ago CRC lead times were averaging 6 weeks.

Galvanized lead times also remained essentially the same as what we have been reporting since mid-January at 5 weeks. This too is one week shorter than the 6 weeks reported at this time last year.

Galvalume lead times have been running at approximately 5.5 weeks for a number of months with our most recent average being 5.67 weeks. One year ago AZ lead times were 6.67 weeks.