Prices

May 10, 2015

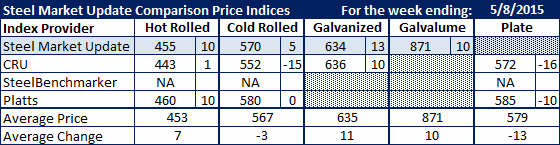

Comparison Price Indices: Not Total Unison But Prices Moving Higher

Written by John Packard

Flat rolled prices have begun to climb out of the hole which has been almost a year in making. Steel Market Update and Platts both saw benchmark hot rolled prices as being up $10 per ton this past week while CRU had HRC up $1 per ton. The HRC average of the three reporting indexes is now $453 per ton, up $7 per ton from one week ago.

Cold rolled prices, which have been on a bit of an odd run as they have been outside of the normal HR/CR spread for a number of months, appear to be coming back into sync with hot rolled coil. The normal spread between HR and CR/coated is normally $100 to $120 per ton. With the latest movement in HR prices SMU now has the spread at $115 per ton, Platts at $120 and CRU at $109 per ton. The average was down $3 per ton all due to the drop in the CRU index ($15).

Galvanized rose on both the SMU and CRU indexes and we may be as close to the same as we have been for a number of months. The average of the two indexes is not $635 per ton, up $11 per ton over the previous week.

SMU also saw Galvalume prices as being up $10 per ton.

Plate, on the other hand, continues to drop as both CRU and Platts saw plate prices as lower than last week.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.