Market Data

May 21, 2015

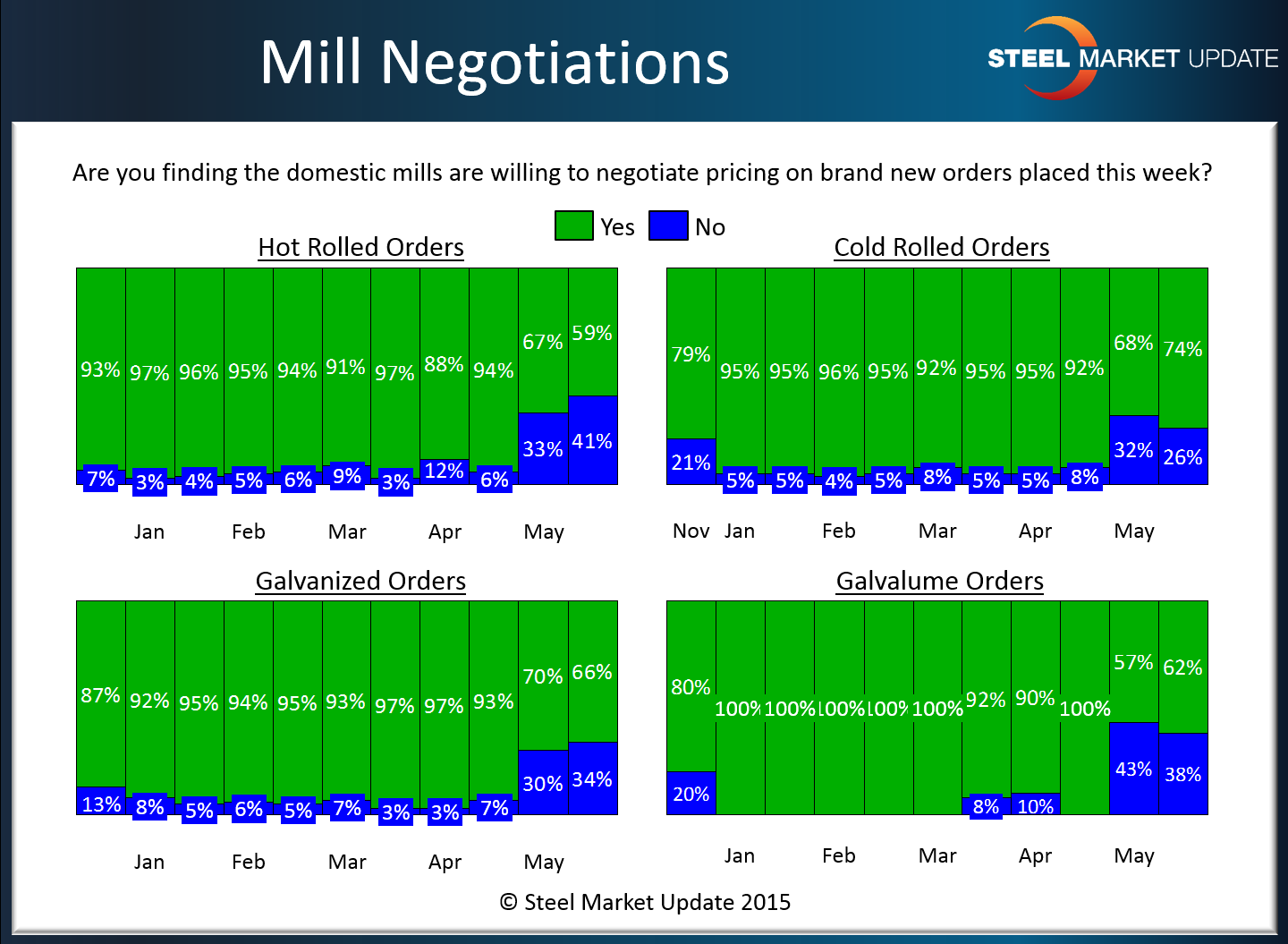

Steel Mills Not Yet Negotiating from a Position of Strength

Written by John Packard

U.S. and Canadian steel buyers reported mills as less willing to negotiate flat rolled steel prices (hot rolled, cold rolled, galvanized and Galvalume prices) at the beginning of the month of May. Prior to that, the domestic steel mills had been extremely active and willing to negotiate pricing on all products. This, according to our flat rolled steel market survey conducted during the first week of May.

Steel Market Update (SMU) conducted our mid-May survey beginning on Monday of this week concluding our analysis earlier today. We found improvements (respondents reporting mills as less willing to negotiate pricing) on hot rolled and galvanized. The cold rolled and Galvalume results were slightly less optimistic as more respondents reported the mills as willing to negotiate than what we saw at the beginning of the month.

However, the rate of change was miniscule on virtually all products and we are not yet convinced that the industry is able to collect much higher pricing based on these results. We would call the results as being mixed at best and still a far cry from where the domestic mills need to be to push prices even higher from here.

Steel Market Update believes the domestic mills need to get lead times out another week on various products in order to improve their negotiating positions.

To view the interactive history of the graphic above, visit the Steel Mill Negotiations page on the Steel Market Update website here.