Market Data

June 18, 2015

USW, US Steel & ArcelorMittal Negotiations Are You Preparing?

Written by John Packard

Steel Market Update reported in the Tuesday issue of our newsletter that negotiations have started between the USW (United Steelworkers Union) and ArcelorMittal.

The issue was raised at the Bank of America Merrill Lynch dinner where SMU publisher, John Packard, spoke last night. We have been anticipating that the posturing by the union and AM, as well as US Steel, will be one of the main topics of the summer. This is indeed the case.

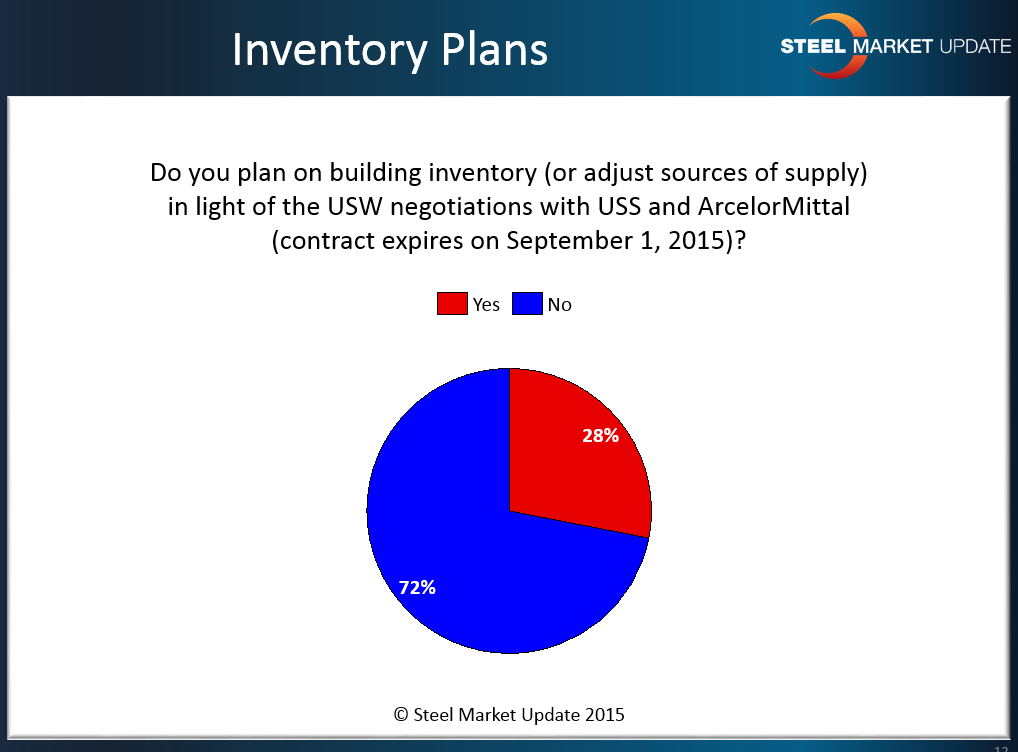

We asked our survey respondents, “Do you plan on building inventory (or adjust sources of supply) in light of the USW negotiations with USS and ArcelorMittal (contract expires on September 1, 2015)?”

Thirty-one percent (31%) of our respondents reported that they would be building inventory and/or adjusting sources of supply in order to protect their businesses. This leaves a full 71 percent who are comfortable with their current situation and supply sources.

This was another question where the respondents chose to leave comments regarding the question or their response:

“We are considering a slight building of inventory. But we are closely watching the UAW/Automaker negotiations as this has an impact on price/availability as well.” Manufacturing company

“Inventory build yes source adjustment no.” Service center

“We will build inventory for our OEM customer base.” Service center

“We are looking at alternative sources for the items purchased from USS and AM. “ Service center

“There will be some areas I’m sure where we build a small bank but based on the strength of our relationship with Arcelor, we will work together so our customers are protected.” Service center

“Not expecting a strike. Lots of posturing but too much red ink at Steelmakers my bigger concern is the UAW.” Service center