Market Data

June 30, 2015

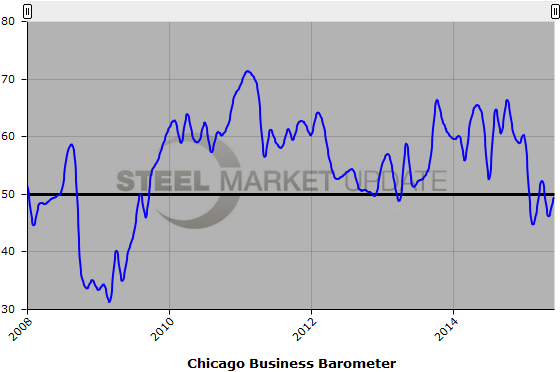

Chicago Business Barometer Fails to Cross Into Growth Territory

Written by Sandy Williams

The June Chicago Business Barometer gained back half of May’s losses but remained in contraction for the second consecutive month and the fourth so far this year. The Barometer rose 3.2 points to 49.4 from 46.2 in May.

Overall, the barometer declined 1.2 points in second quarter, registering 49.3 from 50.5 in Q1, its lowest level since Q3 2009. MNI Indicators calls it a “signal that the bounceback in economic growth in Q2 may be weaker than expected.”

New orders expanded by 8.8 percent in June to 51.7. Production rose 8.7 percent but remained in contraction.

Employment, order backlogs and supplier deliveries all continued to contract in June.

Businesses continued to reduce excess inventory levels, falling 12 percent in June and entering contraction for the first time in four months.

Prices paid rose for the second month and to the highest level since December.

Despite dismal results in June, survey panelists expressed optimism for third quarter.

Chief Economist of MNI Indicators Philip Uglow said, “While the latest increase in New Orders is a tentative sign of a pick-up in demand over the coming months, there is no getting away from the general softness in the data. The Barometer hit a 5½ year low in Q2 and the weakness is having a detrimental impact on the level of hiring.”

The Chicago Business Barometer is an economic indicator based on surveys of purchasing/supply chain professionals in the Chicago area. A monthly publication of MNI Indicators and the Institute for Supply Management, the index is based on responses of manufacturing and non-manufacturing firms who primarily are members of ISM. An index reading above 50 indicates expansion while a number below 50 indicates contraction.

SMU Note: Below is a graphic showing the Chicago Business Barometer history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.