Prices

July 8, 2015

May 2015 Steel Exports Well Below 2014 Levels

Written by Sandy Williams

AIIS, Falls Church, VA. July 9, 2015. Steel exports increased 3 percent from April to May, though they remained well below the level of a year ago.

The United States shipped 870,099 net tons of steel in May, 16 percent less than the May 2014 total.

Most of the growth resulted from a more than nine-fold increase in exports to the Dominican Republic, to 36,750 net tons, making the tiny nation the third-largest buyer of steel from the United States in May. The monthly total was more than half of the amount of steel that was exported to the Dominican Republic by the United States in all of 2014. Canada and Mexico are, by far, the top two recipients of U.S. steel, and exports to Canada were nearly unchanged in May at 408,729 net tons, while exports to Mexico declined 5.5 percent to 313,828 net tons. Compared to a year earlier, Canada’s total was down 26.9 percent, while Mexico’s fell 13.6 percent. Exports to the European Union slid 9.5 percent from April to May, and 4.8 percent from May 2014 to May 2015, to 27,015 net tons.

Through the first five months of the year, total exports were down 12.1 percent to 4.41 million net tons. Exports to Canada decreased 21 percent to 2.13 million net tons, while exports to Mexico slipped 1 percent to 1.7 million net tons. The European Union increased its year-to-date purchases of steel from the United States by 16.9 percent to 168,054 net tons. The Dominican Republic had been trending well behind its 2014 pace, so even with the big jump in May, its year-to-date total of 48,800 net tons was only 11.4 percent ahead of last year.

With Canada accounting for roughly half of all foreign purchases of steel from the United States, the steep decline in exports north of the border equals almost the entire dip in total exports from 2014 to 2015. Although Canada’s finance minister insists that the country is not in a recession, many economists disagree. It is clear, though, that the nation’s economy is at least struggling. Statistics Canada has announced that non-residential capital spending is expected to drop by nearly 5 percent from 2014 to 2015, with the decline in the private sector reaching 7 percent. Until conditions improve for the United States’ top trading partner, steel exports will likely continue to suffer.

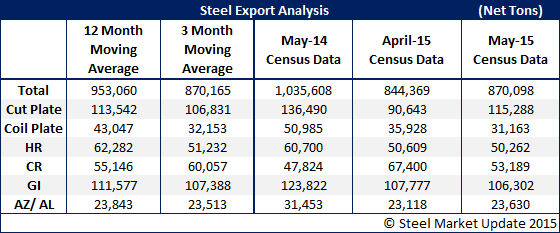

The table below is provided by Steel Market Update and compares May 2015 exports to the three and twelve month moving averages through May, exports one year prior, and the previous month. An interactive graphic can be seen on our website here.

Source: American Institute for International Steel (AIIS).