Market Data

July 9, 2015

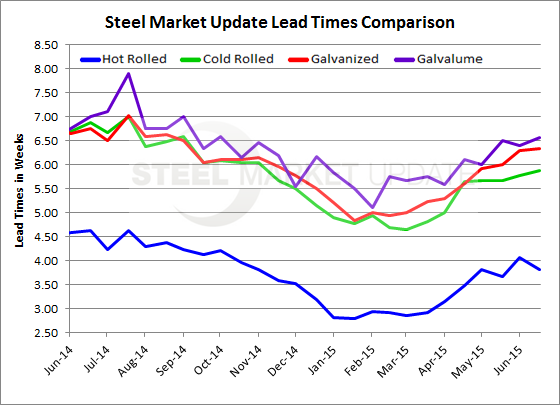

Mill Lead Times Remain Stuck at Mid-June Levels

Written by John Packard

Even with a new price increase announcement out of US Steel (+$40) lead times remain flat compared to what we saw during the middle of June. All of the products, hot rolled, cold rolled, galvanized and Galvalume lead times are shorter than what we reported at the beginning of July 2014.

Hot rolled lead times remain stuck averaging just under 4 weeks, based on the responses received during this week’s flat rolled steel survey results. The four weeks is an average of the responses received from both manufacturing companies and service centers. Mill responses are not considered for this particular group of data. Hot rolled was averaging 4.63 weeks one year ago.

Cold rolled lead times averaged 5.88 weeks, exactly one week less than one year ago and just about the same as the 5.78 reported during the middle of June.

Galvanized lead times also remained range bound at 6.33 weeks, almost exactly the same as mid-June and about one half week shorter than the 6.76 weeks reported this time last year.

Galvalume, like galvanized, was also one half week shorter than one year ago and is averaging 6.56 weeks. The lead times on AZ has barely moved over since the beginning of June.

To see an interactive history of our Steel Mill Lead Time data, visit our website here.