Prices

July 12, 2015

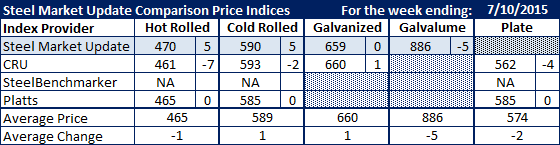

Comparison Price Indices: Nowhere to Go

Written by John Packard

Up, down and sideways is how to describe the various flat rolled price indexes this past week. Hot rolled prices averaged $465, down $1 from the week prior. However, the SMU index was up $5 per ton to $470, CRU was down $7 per ton to $461 and Platts remained stationary at $465 per ton for the third week in a row.

Cold rolled price average was up $1 per ton to $589 per ton. SMU saw CRC prices as being up $5 per ton to $590, CRU saw prices down $2 per ton to $593 and Platts kept cold rolled at $585 per ton for the third week in a row. Platts adjusted cold rolled the week of June 26th. Prior to that Platts had CRC at $580 per ton all the way back to the week of April 10th.

Galvanized prices were up $1 per ton on the strength of the CRU move from $659 to $660. SMU continues to show GI at $659 per ton for .060” G90.

Galvalume was down $5 per ton on .0142” AZ50, Grade 80 and is now referenced at $886 per ton.

Plate average price dropped $2 per ton to $574 per ton. Platts remained at $585 per ton as they have been since May 8th. CRU was down $4 per ton to $562 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.