Prices

July 19, 2015

Comparison Price Indices: A Road to Nowhere?

Written by John Packard

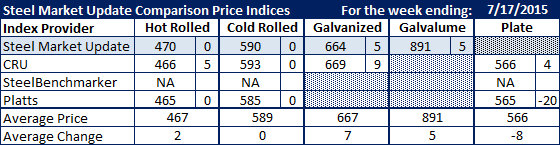

Stability is perhaps the most frightening for steel buyers and sellers alike. At least there is an expectation of good times (or bad) when prices are moving on a weekly basis in one direction or the other. What we have seen since the middle of May is a slight “jiggle” as prices bounce up and down with no true direction or purpose. This past week did not see any breakout as SMU analyzed what was reported by the other steel price indexes that we follow on a regular basis.

This past week the steel indexes followed by Steel Market Update continued to show prices as barely moving despite price increase announcements and a coated steel trade case.

Hot rolled continued to be weak and you can throw a hand towel over SMU, Platts and CRU as their HRC prices are that close together this week. SMU is the highest at $470 per ton with CRU ($466) and Platts ($465) following behind.

According to the three indexes reporting this past week (SteelBenchmarker did not report prices last week) cold rolled prices went nowhere. All of the indexes reported CRC at the same numbers as the week prior.

Galvanized and Galvalume bucked the trend by rising compared to the prior week. Galvanized was up $5 (SMU) and $9 (CRU) while Galvalume was up $5 (SMU).

Plate prices were sideways at Platts and up $4 per ton according to CRU.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.