Market Data

July 23, 2015

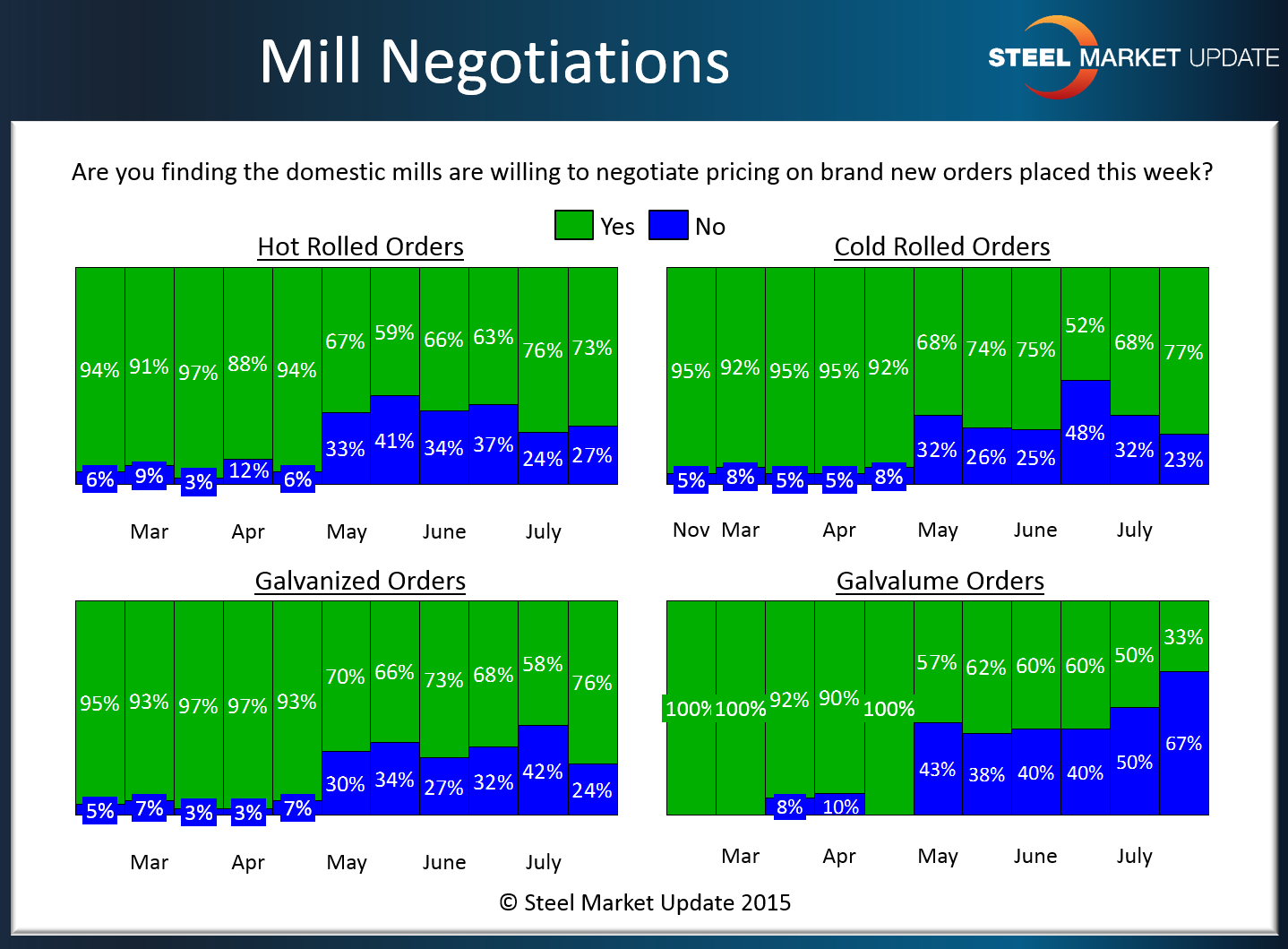

Steel Mill Negotiations: Sideways Except Galvalume

Written by John Packard

Last week, Steel Market Update adjusted our Price Momentum Indicator to Neutral from Higher. A portion of that change was due to the domestic steel mills continuing to be willing to negotiate flat rolled steel pricing.

In this week’s flat rolled steel market analysis, those responding to our questionnaire reported all but Galvalume as being highly negotiable (70 percent level or higher). Hot rolled (73 percent, cold rolled (77 percent) and galvanized (76 percent) improved modestly during the month of May and have essentially trended sideways since.

The one exception is Galvalume where we have seen AZ move below 50 percent for the first time in many months. The current level at 33 percent is the first time we have seen levels at, or under, 40 percent since early August of last year.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.