Market Data

August 6, 2015

SMU Steel Buyers Sentiment Index: Just Like Prices, Moving Sidways

Written by John Packard

Steel Market Update (SMU) reported their Steel Buyers Sentiment Index (current situation) to be unchanged from the last measurement made during the middle of July. The +56 being reported is down 2 points from the beginning of July and 12 points from the +68 reported at the beginning of August 2014.

The Steel Buyers Sentiment Index measures how flat rolled steel buyers and sellers think about their company’s ability to be successful in the existing market environment. SMU also measures how these same buyers and sellers of steel feel about their company’s ability to be successful three to six months into the future. Steel Market Update has been measuring Sentiment since November 2008.

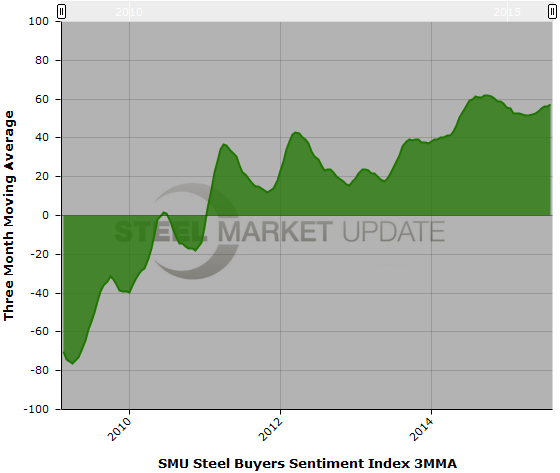

The three month moving average (3MMA) of the SMU Buyers Sentiment Index (current situation) is +57.33 and has been rising over the past three months as you can see in the graphic below (graphic is one of the interactive graphs you can find on our website).

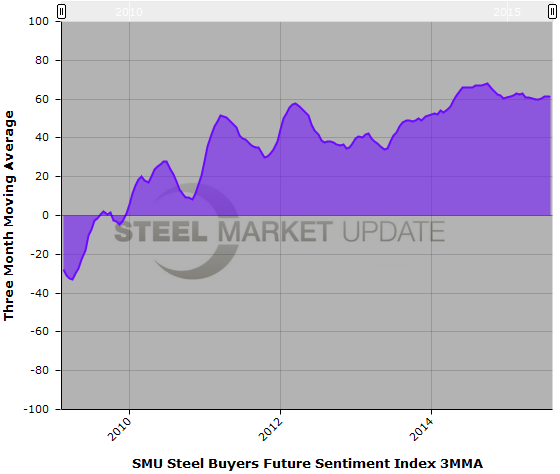

The SMU Buyers Future Sentiment Index was +59 in our latest market analysis. This is one point lower than our last survey from mid-July and down five points from one month ago. One year ago the Buyers Future Sentiment Index was at +69.

The 3MMA of the SMU Buyers Future Sentiment Index is +61.17, down from the mid-July reading of +61.33. According to the 3MMA graphic (below) Sentiment has been moving sideways from the mild peak made earlier this year.

What Our Respondents Had To Say

“We feel very confident we have fulfilled all expectations of selling unfair trade basis and our analysis shows no dumping operations at all. These compared to other competitors will bring very competitive advantages once the HRC suit is announced.” Trading Company

“Chinese gone and very slow to arrange new sourcing.” Trading Company which went on to talk about inventories, “The over-purchasing has finally caught up with us and demand seems to be suffering a little.”

“[We] need some market help and stability with steel.” Manufacturing Company

“Resolved to the fact that this IS the new normal and that a recovery of scale is not on the horizon.” Service Center

“Momentary drop in apparent demand – summer blahs.” Steel Mill

“4th Quarter is always slower so business is about normal.” Service Center/Manufacturer

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 43 percent were manufacturing and 43 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.