Market Data

August 20, 2015

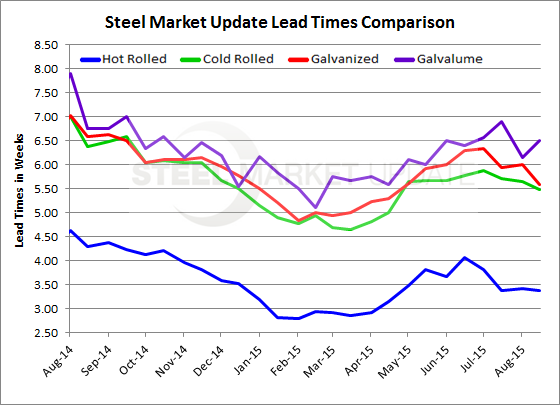

Steel Mill Lead Times Weaker than Last Year

Written by John Packard

Lead times for hot rolled, cold rolled, galvanized and Galvalume steels continue to remain moderately short at most of the domestic steel mills according to the results of this week’s flat rolled steel market analysis.

Hot rolled lead times averaged 3.38 weeks which is essentially unchanged over the past month and below the 4 week average we were reporting in mid-June and early July. Last year at this time HRC lead times averaged 4.30 weeks, a full week longer than what we are seeing today.

Cold rolled lead times averaged 5.48 weeks, again essentially unchanged from the 5.65 weeks from the beginning of the month. CRC lead times have been basically flat going all the way back to May. One year ago lead times were one week longer at 6.38 weeks.

The story on galvanized is similar to that of cold rolled. Lead times averaged 5.58 weeks or down slightly from the 6.0 weeks reported at the beginning of August. Last year lead times were extended by one more week to 6.58 weeks.

Galvalume bucked the trend with our average being slightly longer at 6.50 weeks than the 6.14 weeks reported at the beginning of August. Galvalume lead times are close to what was reported one year ago (6.75 weeks).

To see an interactive history of our Steel Mill Lead Time data, visit our website here.

add pic