Market Data

August 26, 2015

Durable Goods Orders Rise for Second Month

Written by Sandy Williams

The Durable Goods report from the US Census Bureau showed a 2 percent increase month to month of new orders in July. New orders data was stronger than expected and the second month of gain after an advance in June of 4.1 percent. July’s increase was led by orders for automotive and military goods.

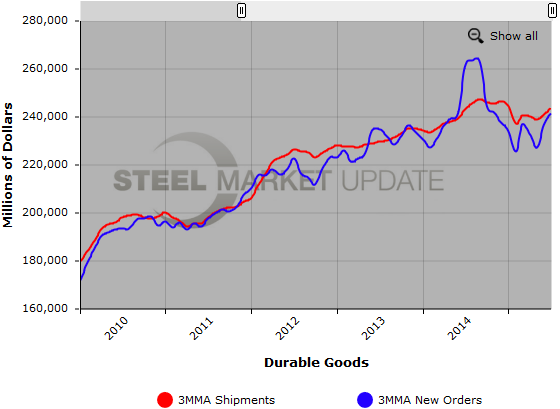

The three month moving average (3MMA) increased by 1.23 percent month over month. The year over year growth rate of the 3MMA came in at negative 9.98 percent in July, deteriorating for the tenth straight month.

The press release from the Commerce Department read as follows:

New Orders. New orders for manufactured durable goods in July increased $4.6 billion or 2.0 percent to $241.1 billion, the U.S. Census Bureau announced today. This increase, up two consecutive months, followed a 4.1 percent June increase. Excluding transportation, new orders increased 0.6 percent. Excluding defense, new orders increased 1.0 percent. Transportation equipment, also up two consecutive months, led the increase, $3.8 billion or 4.7 percent to $83.2 billion.

Shipments. Shipments of manufactured durable goods in July, up two consecutive months, increased $2.3 billion or 1.0 percent to $243.2 billion. This followed a 0.9 percent June increase. Transportation equipment, also up two consecutive months, led the increase, $1.9 billion or 2.5 percent to $80.3 billion.

Unfilled Orders. Unfilled orders for manufactured durable goods in July, up two consecutive months, increased $2.3 billion or 0.2 percent to $1197.5 billion. This followed a virtually unchanged June increase. Transportation equipment, also up two consecutive months, drove the increase, $2.9 billion or 0.4 percent to $802.6 billion.

Inventories. Inventories of manufactured durable goods in July, down two of the last three months, decreased $0.1 billion or virtually unchanged to $402.1 billion. This followed a 0.4 percent June increase. Primary metals, down six consecutive months, drove the decrease, $0.2 billion or 0.5 percent to $37.1 billion.

Capital Goods. Nondefense new orders for capital goods in July increased $0.9 billion or 1.1 percent to $82.3 billion. Shipments increased $0.1 billion or 0.1 percent to $79.3 billion. Unfilled orders increased $3.1 billion or 0.4 percent to $762.2 billion. Inventories increased $0.2 billion or 0.1 percent to $177.3 billion. Defense new orders for capital goods in July increased $2.0 billion or 22.3 percent to $11.0 billion. Shipments increased $0.2 billion or 1.5 percent to $10.6 billion. Unfilled orders increased $0.5 billion or 0.3 percent to $149.8 billion. Inventories increased $0.2 billion or 1.0 percent to $23.0 billion.

Revised June Data. Revised seasonally adjusted June figures for all manufacturing industries were: new orders, $480.0 billion (revised from $478.5 billion); shipments, $484.4 billion (revised from $483.5 billion); unfilled orders, $1,195.2 billion (revised from $1,194.7 billion); and total inventories, $652.6 billion (revised from $653.6 billion).

Below is a graph showing the history of durable goods shipments and new orders 3MMA. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.