Prices

September 15, 2015

SMU Price Ranges & Indices: QUIET Market

Written by John Packard

The key word that we are hearing from steel buyers and mills alike is the market is QUIET, very, very quiet. Lead times referenced continue to be short. Inventories continue to be high. We did not collect any huge changes in our key product averages. We are hearing that extras on many products are being discussed and that our hot rolled number may be slightly over stated when taking that into consideration.

As a side note, zinc spot LME numbers as reported by Kitco.com this afternoon closed at $.7816 per pound very close to the five year low. In our next flat rolled market analysis which is scheduled for next week we will ask questions about extras and if the extras are being negotiated on both galvanized (zinc) and Galvalume (zinc/aluminum). In fairness to those interested in aluminum it closed today at $.7217 per pound, also near 5 year lows.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $420-$460 per ton ($21.00/cwt- $23.00/cwt) with an average of $440 per ton ($22.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range are unchanged compared to last weeks prices. Our overall average is the same compared to one week ago. SMU price momentum for hot rolled steel is Neutral at the moment but we are seeing short term pockets of weakness which could take prices lower over the next couple of weeks.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $550-$590 per ton ($27.50/cwt- $29.50/cwt) with an average of $570 per ton ($28.50/cwt) FOB mill, east of the Rockies. The lower end of our range was unchanged compared to one week ago while the upper end declined $10 per ton. Our overall average is down $5 per ton compared to last week. SMU price momentum on cold rolled steel is at Neutral but, like hot rolled above, we could see a weakening in prices over the next two or three weeks.

Cold Rolled Lead Times: 4-8 weeks.

Galvanized Coil: SMU Base Price Range is $27.00/cwt-$29.00/cwt ($540-$580 per ton) with an average of $28.00/cwt ($560 per ton) FOB mill, east of the Rockies. The lower end of our range was unchanged compared to last week while the upper end declined $10 per ton. Our overall average is down $5 per ton compared to one week ago. Our price momentum on galvanized steel is Neutral with some pockets of short term weakness.

Galvanized .060” G90 Benchmark: SMU Range is $609-$649 per net ton with an average of $629 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-7 weeks.

Galvalume Coil: SMU Base Price Range is $28.00/cwt-$30.50/cwt ($560-$610 per ton) with an average of $29.25/cwt ($585 per ton) FOB mill, east of the Rockies. The lower end of our range declined $15 per ton compared to one week ago while the upper end was unchanged. Our overall average is down $7.50 per ton compared to last week. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards Neutral but with a short term downward tilt.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $851-$901 per net ton with an average of $876 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

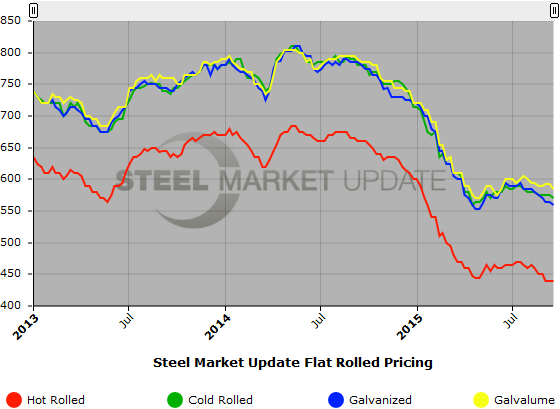

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.