Prices

October 18, 2015

Zinc Breaks Through Short-Term Resistance Levels

Written by John Packard

During our Steel Summit Conference in September, Lisa Reisman the founder and Executive Editor of Metal Miner told those in attendance that the short term outlook for commodities and steel was bearish. She provided a number of support and resistance price points on a number of steel products as well as aluminum and zinc.

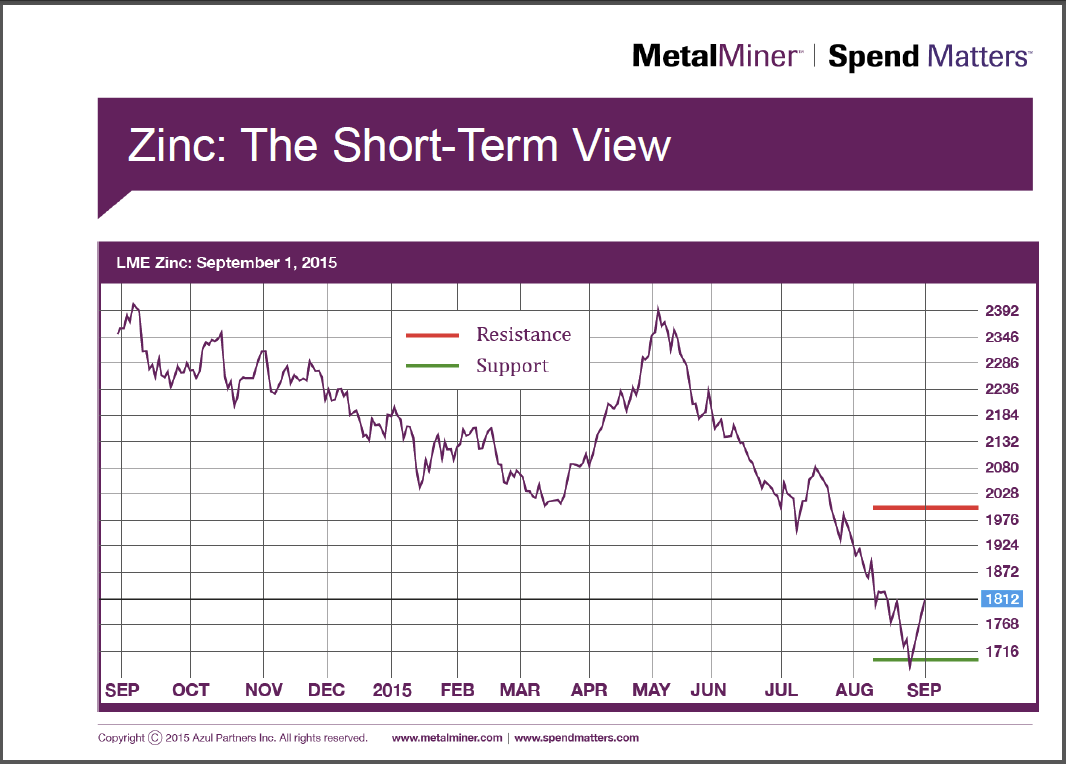

In the Power Point slide shared with our attendees on September 2nd, Ms. Reisman put the resistance level for zinc at approximately $2000 per metric ton ($0.91 per pound) with the support level of $1716 per metric ton ($0.78 per pound). The slide below is from Ms. Reisman’s presentation which is available on our App to all who attended our conference.

She also pointed out that buyers (steel and commodities) need to be aware that the data in early September was:

• Nothing indicates an upward trend

• Production costs have no merit on today’s prices (Hint: They are irrelevant)

• Beware of falling knives!

• Look at incongruent data and analyze the micro trends:

o Falling Chinese exports (all commodities)

o Rising Chinese zinc production (on less demand)

o Rising Chinese steel exports (27% bump in July)

As the month of September progressed, we saw zinc as being the worst of all the base metals breaking through the support levels shared with SMU attendees and hitting five year lows during the process.

We asked Ms. Reisman to provide us some insights into their view on zinc prices in light of the recent price moves and she provided us with the following:

“Zinc and lead made big price moves last week, breaking our short-term resistance levels on high trading volume. Essentially, we don’t think this is a dead cat bounce per se but there has been some price strength as zinc prices moved above our short-term resistance level. However, if you look at our support/resistance in the annual report (e.g. the longer term forecast), you will see that zinc remains well below resistance levels which tells us that the long term bear trend remains in place. However, for those buying organizations that do not buy on long term contract (e.g. they buy on the spot market) it makes sense to hedge short term demand for zinc. If we start seeing zinc prices exceed the annual report resistance levels on higher trading volume, then we have reason to believe that the market may be turning from bear to bull. But until then, we’re only seeing some short term price support which may or may not be short-lived.”

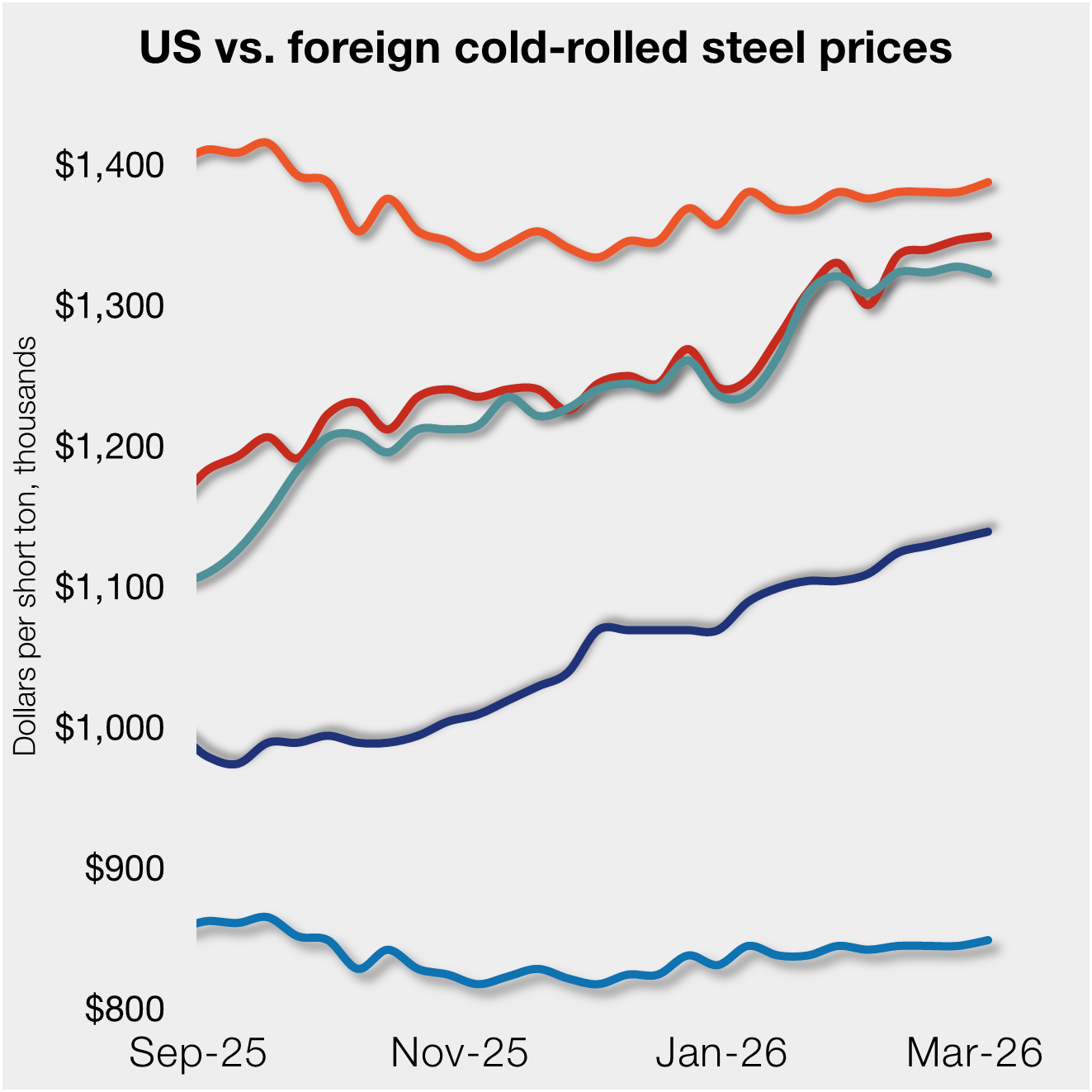

Most of the domestic mills have adjusted coating extras to levels similar to those announced by U.S. Steel which became effective on April 1, 2015. When the announcement was made spot zinc was trading at approximately $0.90 per pound.

Metal Miner is of the opinion that zinc will continue to exhibit weakness based on the data coming out of China, as the country ramps up zinc production while at the same time business conditions in the country slow. The near term trend continues to be for weakening zinc prices which could very well drop to six year lows as have other metals. The bear market continues for commodities and, at the same time, the dollar remains strong.