Market Data

November 19, 2015

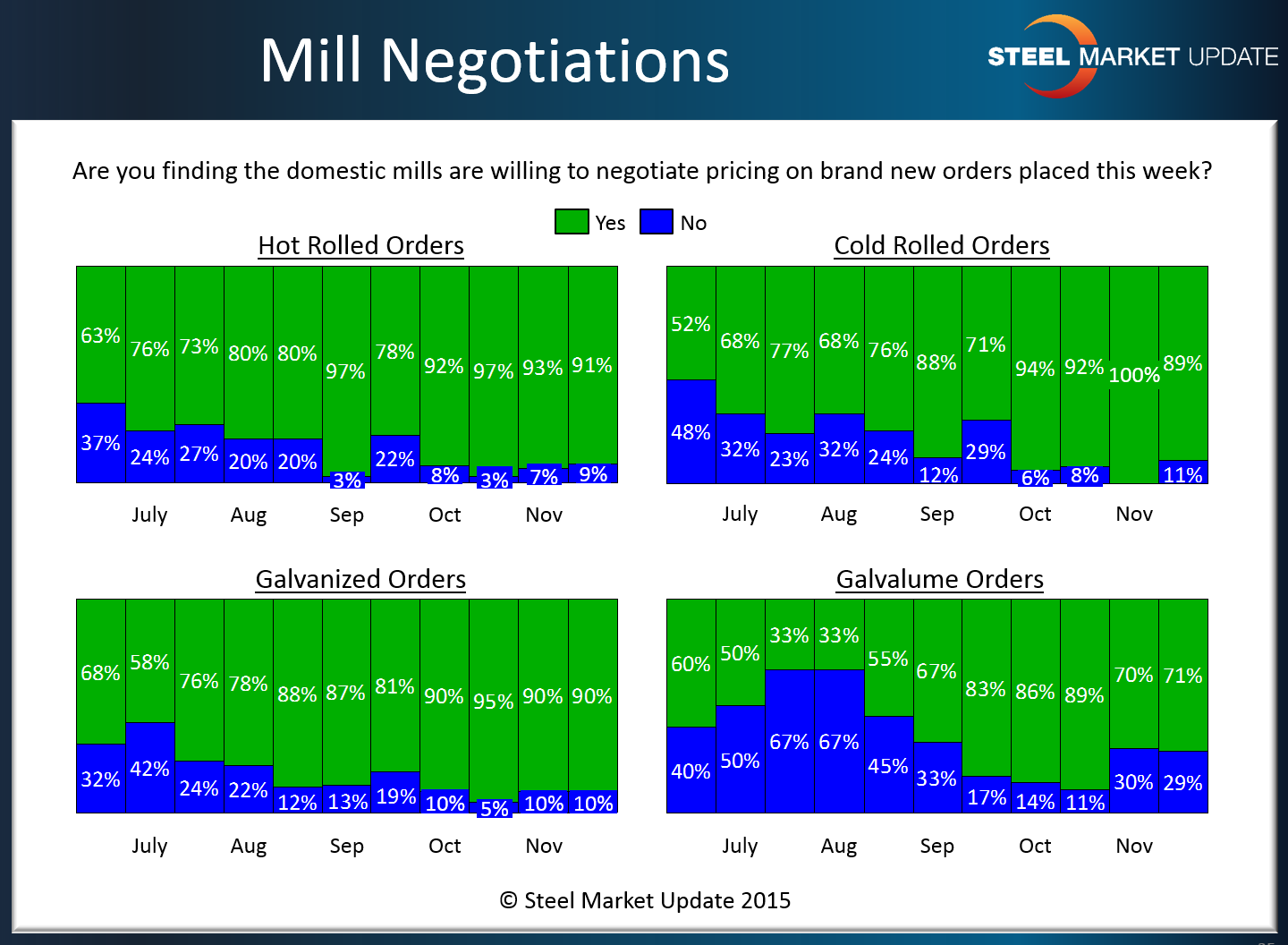

Domestic Mill Steel Price Negotiations: Everybody’s Still Talking…

Written by John Packard

Based on the results of this week’s flat rolled steel market analysis (survey) conducted by Steel Market Update (SMU) the flat rolled steel mills continue to aggressively pursue orders by negotiating spot prices on hot rolled, cold rolled, galvanized and to a slightly lesser extent, Galvalume.

As you can see by the graphic shown below, 91 percent of those responding to our questionnaire reported the domestic mills as willing to discuss hot rolled prices. This is essentially in line and unchanged from what we gathered at the beginning of this month and just slightly lower than the 97 percent reported one month ago.

Cold rolled products saw a slight decrease in those reporting the domestic mills as willing to negotiate CR prices. Eighty-nine percent of our respondents reported the mills as willing to negotiate CR pricing. This is down 11 percent compared to two weeks ago but is in line with the data collected during the middle of October.

Our respondents reported that the mills as willing to negotiate with 90 percent of our respondents reporting that way. This is essentially in line with what we have been collecting over the past couple of months.

Seventy-one percent of our respondents reported the domestic mills as willing to negotiate Galvalume prices. This is unchanged from two weeks ago but is well below the high 80’s that we were collecting during September through the middle of October.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.