Prices

November 24, 2015

SMU Price Ranges & Indices: Reaching for the Bottom?

Written by John Packard

All eyes are looking ahead to after the Thanksgiving Holidays. As lead times approach the New Year (for hot rolled coil, most coated products are already well into 1st Quarter 2016) and customers think of restocking/preparing for 2016 business levels, this tends to be prime time for the domestic mills to announce price increases. To make matters more interesting we have US Steel confirming today that they will idle the Granite City Works plant after idling most of the Fairfield Works facility recently. At the same time AK Steel is idling Ashland.

The general manager of one of the larger service centers told SMU in an email this evening, “I think we’ll see impacts after the Thanksgiving holiday with buyers moving to place orders elsewhere, which should put floor on pricing.”

Others are not so sure with one east coast service center executive telling us, “I believe everyone is de-stocking and the distributors are the problem, not the mills. Service Centers are selling steel below their costs or using the newest steel and letting their high priced inventory remain. The closing of the facilities will help, long term, not short term. Too much inventory and too much sitting on the docks. I believe we will be into February before this glut is over. The only question out there is when will the domestic mills raise their prices?”

As we enter this Thanksgiving Holiday, Steel Market Update continues to have our Price Momentum Indicator pointing toward lower prices. However, we are of the opinion that we are now talking days and not a month or longer. We will see what the month of December brings.

In the meantime, here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $360-$390 per ton ($18.00/cwt- $19.50/cwt) with an average of $375 per ton ($18.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end declined $10 per ton. Our overall average is down $5 per ton compared to one week ago. SMU price momentum for hot rolled steel has prices moving lower over the coming days.

Hot Rolled Lead Times: 1-4 weeks.

Cold Rolled Coil: SMU Range is $480-$520 per ton ($24.00/cwt- $26.00/cwt) with an average of $500 per ton ($25.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged from last week. SMU price momentum for cold rolled steel is for prices to slip over the coming days.

Cold Rolled Lead Times: 4-7 weeks.

Galvanized Coil: SMU Base Price Range is $24.00/cwt-$26.00/cwt ($480-$520 per ton) with an average of $25.00/cwt ($500 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end declined $10 per ton. Our overall average is down $5 per ton compared to one week ago. Our price momentum on galvanized steel is for prices to move lower over the coming days.

Galvanized .060” G90 Benchmark: SMU Range is $540-$580 per net ton with an average of $560 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3-7 weeks.

Galvalume Coil: SMU Base Price Range is $25.00/cwt-$27.00/cwt ($500-$540 per ton) with an average of $26.00/cwt ($520 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged from last week. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards lower prices over the coming days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $791-$831 per net ton with an average of $811 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

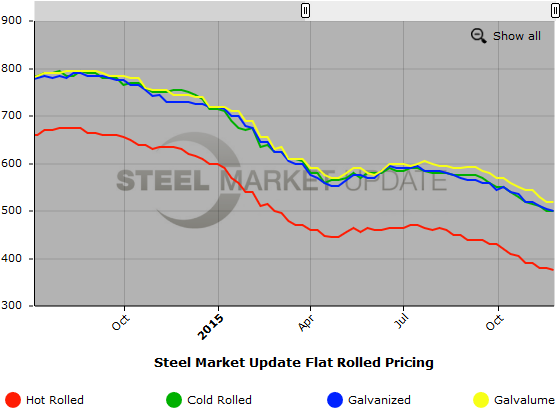

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.