Prices

December 8, 2015

SMU Price Ranges & Indices: Are We There..?

Written by John Packard

The service centers with whom we communicated over the past few days are talking about the “whispers” of a possible price increase announcement. A number have told SMU that mills like SDI Butler and Nucor Berkeley are asking for higher spot prices than what was available two weeks ago. A service center executive told us, “The customers are coming off the sidelines” However, as is generally the case when the word starts to spread with some mills it is too late. This same executive told us, “We are paying $20 to $30 per ton more than a couple of weeks ago.”

The mills are watching and waiting for the right time to make price announcements. Some think that it is just a matter of a day or two thinking that it will happen this week. Whatever the case, our service center executive is of the opinion the price increases will be collected – at least on coated products. “There is an eighty percent chance they will collect on coated,” he told us and then continued, “I am not quite so bullish on hot rolled, maybe they will be able to collect ten dollars.”

The market feels like it is in transition which is one of the reasons why we changed our Price Momentum Indicator to Neutral from Lower. We will have to wait and see if the domestic mills can make the new numbers stick in light of inventory issues and sluggish demand in a number of steel intensive areas.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $340-$380 per ton ($17.00/cwt- $19.00/cwt) with an average of $360 per ton ($18.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to our revised price on Thursday of last week. Our overall average is unchanged from our last price update. SMU price momentum for hot rolled steel has prices remaining within a narrow range (+/-) over the next 30 days.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $465-$500 per ton ($23.25/cwt- $25.00/cwt) with an average of $482.50 per ton ($24.125/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged over one week ago. SMU price momentum for cold rolled steel is for prices to remain within a narrow range (+/-) over the next 30 days.

Cold Rolled Lead Times: 5-7 weeks.

Galvanized Coil: SMU Base Price Range is $23.25/cwt-$25.00/cwt ($465-$500 per ton) with an average of $24.125/cwt ($482.50 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $5 compared to one week ago while the upper end declined $10 per ton. Our overall average is down $7.50 per ton from last week. Our price momentum on galvanized steel is for prices to remain within a narrow range (+/-) over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $525-$560 per net ton with an average of $542.50 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3-8 weeks.

Galvalume Coil: SMU Base Price Range is $24.75/cwt-$26.50/cwt ($495-$530 per ton) with an average of $25.625/cwt ($512.50 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged over one week ago. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards a narrow trading range over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $786-$821 per net ton with an average of $803.50 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

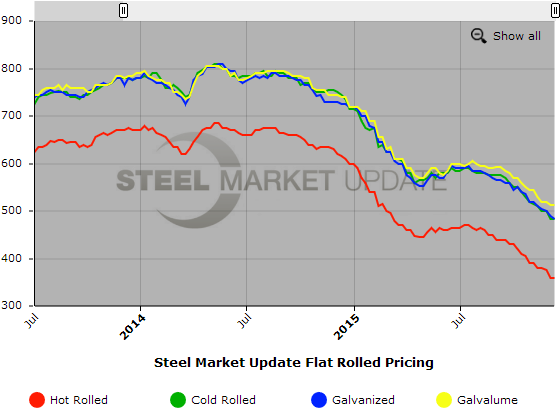

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.