Prices

January 5, 2016

SMU Price Ranges & Indices: Numbers Tweaked as Market Waits for What Comes Next

Written by John Packard

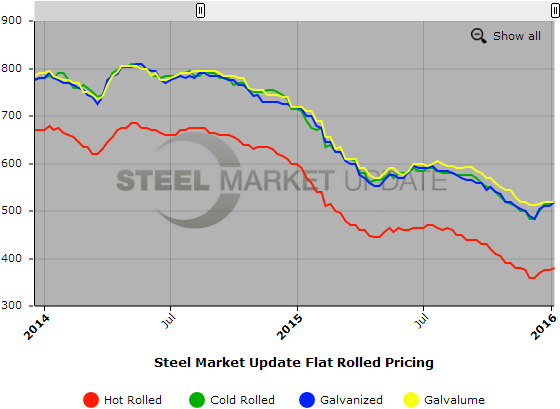

We saw very modest movement in flat rolled steel prices since we last reported prices on Tuesday, December 29th. With most buyers and steel mill commercial people on holiday our new flat rolled market analysis picked up some movement at the upper end of our range in hot rolled, a reduction of the lower end of the range on cold rolled, with both the upper and lower ends of the range adjusted on galvanized and Galvalume remaining the same.

Buyers are reporting that a portion of the price increase has been collected and we will have to wait and see whether there is enough strength in demand to keep lead times moving and embolden the mills to go for a second round of price increases. The expectation by the buyers is that they will (see separate article in this issue).

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $350-$410 per ton ($17.50/cwt- $20.50/cwt) with an average of $380 per ton ($19.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end increased $10 per ton. Our overall average $5 higher over last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: 3-7 weeks.

Cold Rolled Coil: SMU Range is $500-$540 per ton ($25.00/cwt- $27.00/cwt) with an average of $520 per ton ($26.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week while the upper end remained the same. Our overall average is $5 per ton higher than it was one week ago. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks.

Galvanized Coil: SMU Base Price Range is $25.00/cwt-$27.00/cwt ($500-$540 per ton) with an average of $26.00/cwt ($520 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $10 per ton compared to one week ago. Our overall average is up $10 per ton over last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $560-$600 per net ton with an average of $580 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-10 weeks.

Galvalume Coil: SMU Base Price Range is $25.00/cwt-$27.00/cwt ($500-$540 per ton) with an average of $26.00/cwt ($520 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged compared to last week. Our overall average is the same as it was one week ago. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $791-$831 per net ton with an average of $811 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.