Market Data

January 21, 2016

Steel Mill Lead Times Continue to Move Out

Written by John Packard

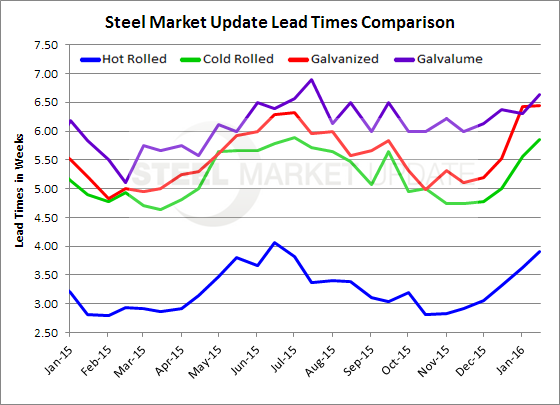

Based on the results of our flat rolled steel market analysis, all of the flat rolled lead times are averaging longer lead times than what we measured one year ago.

The SMU steel market questionnaire found the average lead time on hot rolled coil (HRC) was 3.91 weeks, up from a 3.63 week average reported at the beginning of January and well above the 2.81 weeks reported one year ago. Our respondents are reporting average lead times as being approximately one week further extended than what they were in November 2015.

Cold rolled lead times are averaging almost six weeks (5.85) according to our survey respondents. As with hot rolled, this is approximately one week longer than what we saw last January at this time and one week longer than what we reported in November 2015.

Galvanized lead times were reported to be averaging 6.5 weeks (6.45) which is almost 1.5 weeks longer than what was being reported in November 2015 and slightly more than a week longer than what we saw as the average in mid-January 2015.

Galvalume lead times, which had been relatively stable in recent weeks at about 6.3 weeks, moved out slightly to 6.63 weeks. Lead times now are about a half a week longer than what we saw in November and almost a week longer than what we reported in mid-January 2015.

To see an interactive history of our Steel Mill Lead Time data, visit our website here.