Market Segment

March 8, 2016

Platts: China Steel Sentiment Hits Record High in March

Written by Sandy Williams

Platts publishes a monthly China Steel Sentiment Index. The following is a press release from Platts regarding the latest survey results:

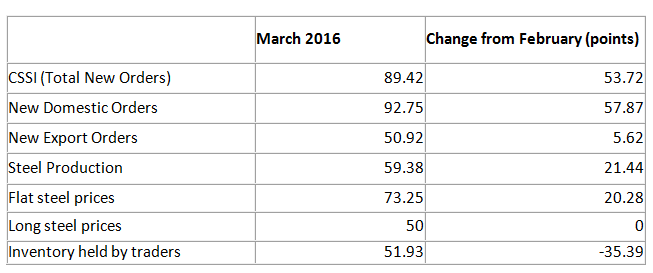

BEIJING, March 8, 2016 – Optimism has returned to the Chinese steel market on the back of buoyant domestic demand for steel and stronger prices, resulting in the Platts China Steel Sentiment Index (CSSI) hitting a record high of 89.42 out of a possible 100 points in March, according to the latest survey conducted by Platts.

![]() The headline index for March rose 53.72 points from the month before and was the strongest reading since the CSSI began in May 2013. A reading above 50 indicates expectations of an increase/expansion and a reading below 50 indicates a decrease/contraction.

The headline index for March rose 53.72 points from the month before and was the strongest reading since the CSSI began in May 2013. A reading above 50 indicates expectations of an increase/expansion and a reading below 50 indicates a decrease/contraction.

The outlook for new domestic orders over the coming month jumped 57.87 points from February to 92.75, while expectations for export orders improved by 5.62 points from the month before to 50.92.

Price expectations for flat steel products, such as hot rolled coil, rebounded by 20.28 points to 73.25, while the price outlook for long steel products, such as rebar, stayed flat on last month’s 50.0 points.

“The steel market recovery seen from the start of 2016 in China has continued beyond the Lunar New Year holiday period in February to the point where domestic hot rolled coil prices are now at a nine-month high,” said Paul Bartholomew, senior managing editor of steel & raw materials for Platts, the leading independent provider of information and benchmark prices for the commodities and energy markets. “Prices have been supported by low inventory levels, and China’s steel mills have lifted production again to take advantage of a rare period of stronger margins.”

Platts China Steel Sentiment Index – March 2016 (a figure over 50 indicates expectations of an increase; under 50 indicates a decrease)

The outlook for crude steel production in March rebounded by 21.44 points from the month before to 59.38, the highest reading for this measure since June 2014. The outlook for steel inventories fell 35.39 points from February to 51.93 in March, indicating the market expects a big draw-down of stocks on stronger sales over the coming month.

“Macro data, such as the manufacturing purchasing managers’ indices, suggest end-user demand for steel in China remains weak. The concern, therefore, is there could be too much steel again within a few months which could result in a price correction,” Bartholomew said.

The CSSI is based on a survey of approximately 60 to 75 China-based market participants including traders and steel mills. Data is compiled by Platts’ Shanghai steel team.

Separate to the CSSI, prices of China export hot rolled coil, as assessed by Platts in February averaged $280.4 per metric ton (/mt) on a free-on-board (FOB) China basis. This was up 3% from the January average of $272.35/mt.

The Platts China Steel Sentiment Index survey plays no role in Platts’ independent price assessment processes. For more information on the Platts price assessment processes and methodology, click here.