Prices

March 8, 2016

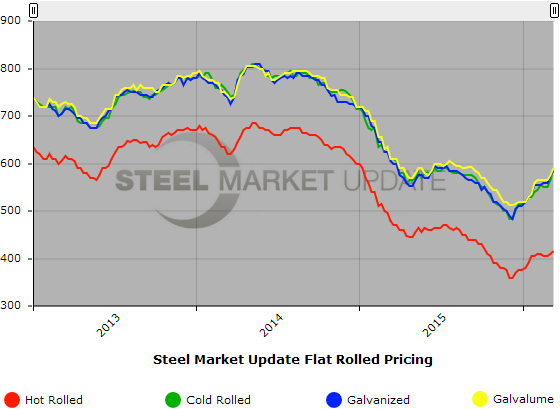

SMU Price Ranges & Indices: Prices Beginning to Move Higher Again

Written by John Packard

Steel buyers are becoming resigned to the fact that steel prices bottomed back in December and the expectation is for prices to go higher from here – even benchmark hot rolled coil. Last week the domestic steel mills announced a $30 per ton price increase. Since then the discussion within the industry has been where does that put the new base prices. As of this evening that question has not been totally answered as a number of mills have been booking at, or just slightly higher, than the numbers we reported last week.

When it comes to hot rolled, we are seeing ranges from $400 (transactions, not the new number) with the new number being somewhere around $430 per ton to as high as AK Steel’s $480 per ton (with little to no spot tonnage available, so why not?). It is our opinion that most buyers are seeing numbers late last week and early this week in the $400-$430 per ton level.

When it comes to cold rolled and coated, there are regional differences as cold rolled in the south is being reported as being about $20 per ton lower than the offers being made in the north. Even so, Momentum is on the side of the domestic mills.

One of the conversion mills told us on Monday afternoon, “Been a wild day. having to restrict order entry. Sort of like throttling data on certain phone plans…” They reported that they were taking prices up, “But first have to make sure our regular accounts get their chance to specify [sizes/tonnage]. Some people are missing the boat. Arguing over $5 or $10 when the market has moved some $30 to $40 since their last booking. We think the +$30 announced was more than fair and that customers who pay that amount will be happy they did.”

At this moment here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $400-$430 per ton ($20.00/cwt- $21.50/cwt) with an average of $415 per ton ($20.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago while the upper end remained the same. Our overall average is up $5 per ton over last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $580-$600 per ton ($29.00/cwt- $30.00/cwt) with an average of $590 per ton ($29.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to last week while the upper end increased $20 per ton. Our overall average increased $25 per ton over one week ago. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: 5-8 weeks.

Galvanized Coil: SMU Base Price Range is $28.00/cwt-$30.50/cwt ($560-$610 per ton) with an average of $29.25/cwt ($585 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end increased $20 per ton. Our overall average is up $10 per ton over last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $620-$670 per net ton with an average of $645 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks.

Galvalume Coil: SMU Base Price Range is $28.50/cwt-$30.50/cwt ($570-$610 per ton) with an average of $29.50/cwt ($590 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week while the upper end increased $20 per ton. Our overall average increased $15 per ton over one week ago. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $861-$901 per net ton with an average of $881 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-9 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.