Market Data

March 20, 2016

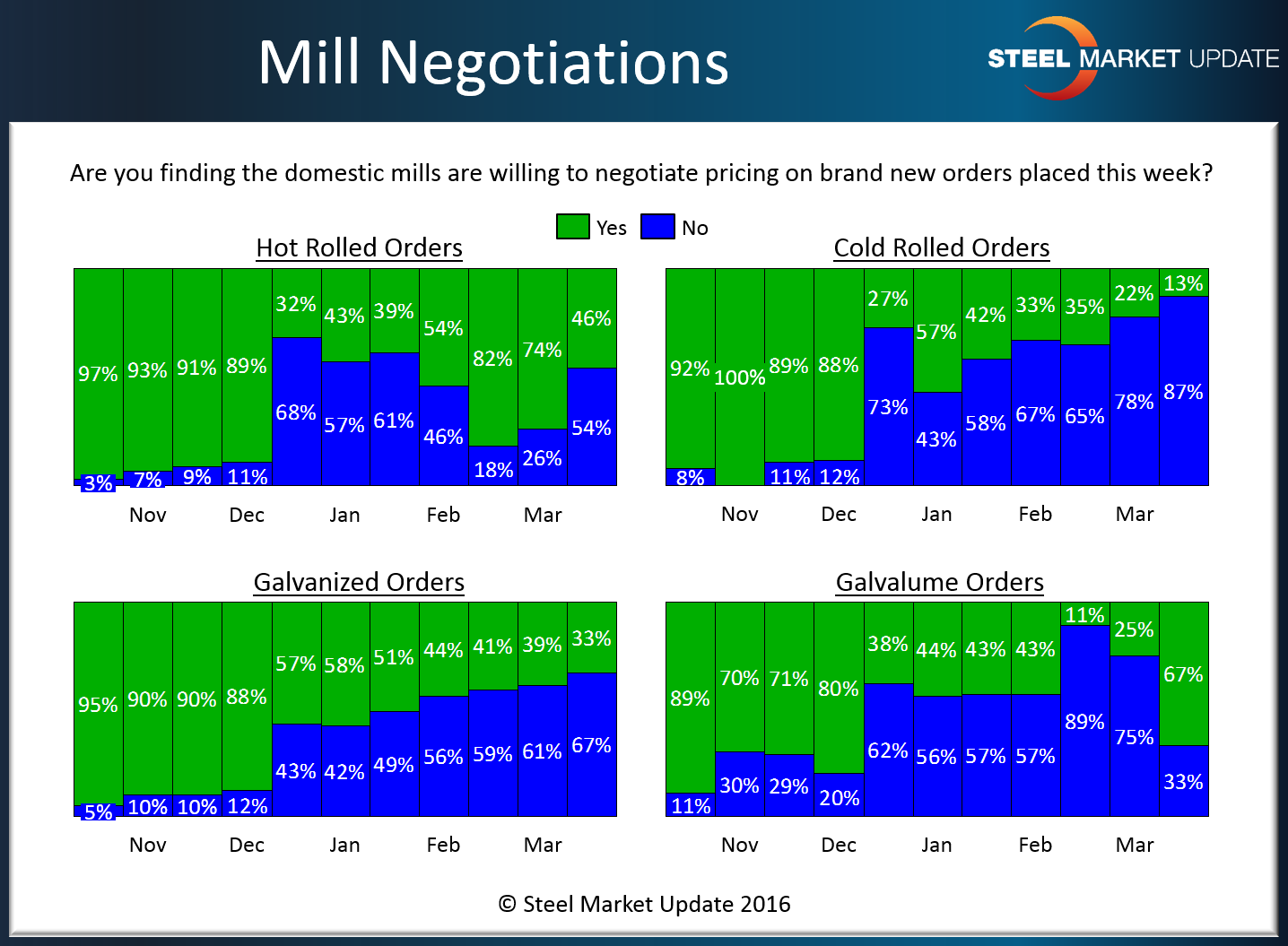

Steel Mill Negotiations: Mills Less Willing to Negotiate

Written by John Packard

Buyers and sellers of flat rolled steel report to Steel Market Update whether the domestic steel mills are willing to negotiate pricing on hot rolled, cold rolled, galvanized and Galvalume steels. The less willing the mills are to negotiate prices the stronger the market (and potentially the higher prices go from here).

Hot rolled negotiations have been in a state of fluctuation up until recently. SMU had been reporting weakness in the HRC markets due to the energy, large equipment and agriculture related market segments which have been weaker than the rest of the steel using segments of the economy. Even so, with the reduction in supply due to the closure of the steelmaking operations at USS Granite City, USS Fairfield and AK Steel Ashland coupled with results in the HRC trade suit, has given the mills new hope in being able to tighten the HRC markets and raise prices. In the graphic below you can see that the percentage of respondents reporting the domestic mills as willing to negotiate HRC prices has dropped from 82 percent in the middle of February to 46 percent this past week.

Cold rolled percentages have shown a strengthening market with only 13 percent of our respondents reporting the mills as willing to negotiate CRC pricing.

Galvanized is another product where the graphic is self explanatory as the percentage of respondents reporting the mills as willing to negotiate has dropped consistently since early December 2015.

Galvalume is the one product where we have seen a change in those reporting. However, we are taking the data with a grain of salt on AZ due to the smaller number of respondents we have compared to the other products. We will watch this one carefully in the coming weeks.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.