Prices

April 10, 2016

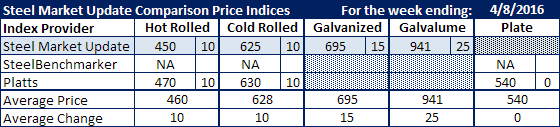

Comparison Price Indices: Double Digit Increases

Written by John Packard

Over the last week flat rolled steel prices continue to increase and, with the latest price announcement coupled with a number of mills having their spot order books closed, the pace seems to have gathered more steam. With the exception of plate (where a dumping suit was filed this past week) all of the flat rolled items rose by double digits.

Benchmark hot rolled rose by $10 per ton on both SMU and Platts. Even so, there is a $20 per ton spread between the two indexes, which is quite unusual and is probably related to collection techniques. Both Platts and SMU take into consideration the asking prices as well as transactional prices.

Cold rolled also rose by $10 per ton and there the two indexes were much closer to one another at $625 (SMU) and $630 (Platts) per ton.

.060” G90 galvanized SMU saw as up $15 and .0142” AZ50, Grade 80 jumped by $25 per ton.

Plate prices remained the same at $540 per ton according to Platts.

SteelBenchmarker did not report prices this past week and therefore was not considered in our analysis.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.